☐ |

Preliminary Proxy Statement | |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☒ |

Definitive Proxy Statement | |

☐ |

Definitive Additional Materials | |

☐ |

Soliciting Material Under Rule 240.14a-12 | |

☒ |

No fee required. | |||

☐ |

Fee paid previously with preliminary materials. | |||

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

April 8, 2024

Dear Graphic Packaging Holding Company Stockholders:

It is my pleasure to invite you to Graphic Packaging Holding Company’s 2024 Annual Meeting of Stockholders, to be held at 1500 Riveredge Parkway, Atlanta, Georgia 30328, on Thursday, May 23, 2024, at 10:00 a.m. local time.

The formal Notice of Annual Meeting and Proxy Statement are enclosed with this letter. The Proxy Statement describes the matters to be acted upon at the Annual Meeting. It also describes how our Board of Directors operates and provides compensation and other information about the management and Board of Directors of Graphic Packaging Holding Company.

Whether or not you plan to attend the Annual Meeting, your vote is important, and I hope you will vote as soon as possible. You may vote over the internet, by telephone or by mailing a proxy or voting instruction card. Voting over the internet, by telephone or by written proxy will ensure your representation at the Annual Meeting, regardless of whether you attend in person. If you hold your shares in your own name and choose to attend the Annual Meeting, you may revoke your proxy and personally cast your votes at the Annual Meeting. If you hold your shares through an account with a brokerage firm, bank or other nominee, please follow instructions from such firm to vote your shares.

Sincerely yours,

Michael P. Doss

President and

Chief Executive Officer

Notice of 2024 Annual

Meeting of Stockholders

Annual Meeting of Stockholders

| Date and Time Thursday, May 23, 2024 10:00 a.m. local time |

Location 1500 Riveredge Parkway Atlanta, Georgia 30328

|

Record Date March 25, 2024 |

| Voting Matters

At the Annual Meeting of Stockholders, we will vote on the following proposals:

Proposal 1 Election of Directors

Proposal 2 Ratification of Independent Registered Public Accounting Firm

Proposal 3 Advisory Vote on Executive Compensation (Say-on-Pay)

Proposal 4 Approval of the Graphic Packaging Holding Company 2024 Omnibus Incentive Compensation Plan

Proposal 5 Simple Majority Vote |

How to vote:

|

|||||||||||

|

|

In Person

|

|

Internet

| |||||||||

| If your shares are registered directly in your name, you are considered a stockholder of record and you may vote in person at the Annual Meeting. If your shares are held beneficially through a bank or brokerage firm, your shares are considered to be held beneficially in street name. If your shares are held beneficially in street name and you wish to vote in person at the Annual Meeting, you will need to obtain a proxy from the bank or brokerage firm that holds your shares. Please note that even if you plan to attend the Annual Meeting in person, the Company recommends that you vote before the Annual Meeting.

|

Stockholders of Record should follow the “Vote by Internet” instructions on their Proxy Card. Stockholders who hold their shares beneficially in street name should vote by accessing the website specified on the voting instruction card provided by their bank or brokerage firm. | |||||||||||

|

|

Telephone |

|

| |||||||||

| Stockholders of Record should follow the “Vote by Phone” instructions on their Proxy Card. Stockholders who hold their shares beneficially in street name should vote by calling the number specified on the voting instruction card provided by their bank or brokerage firm. |

Stockholders of record should complete, sign, date and mail the Proxy Card in the envelope provided. Stockholders who hold their shares beneficially in street name should complete, sign, date and mail the voting instruction card provided by their bank or brokerage firm. | |||||||||||

YOUR VOTE IS VERY IMPORTANT.

EVEN IF YOU PLAN TO ATTEND THE ANNUAL MEETING OF STOCKHOLDERS IN PERSON, PLEASE AUTHORIZE YOUR PROXY OR DIRECT YOUR VOTE BY MAIL, INTERNET OR TELEPHONE AS DESCRIBED ABOVE.

Table of Contents

| Compensation Discussion and Analysis | 22 | |||

| 22 | ||||

| 24 | ||||

| 25 | ||||

| 25 | ||||

| 27 | ||||

| 28 | ||||

| 28 | ||||

| Role of the Compensation and Management Development Committee |

29 | |||

| 29 | ||||

| 30 | ||||

| 30 | ||||

| 30 | ||||

| 32 | ||||

| 32 | ||||

| 33 | ||||

| 34 | ||||

| 34 | ||||

| 34 | ||||

| Employment Agreements, Severance Arrangements and Change of Control Provisions |

35 | |||

| 36 | ||||

| 37 | ||||

| Compensation of Executive Officers | 38 | |||

| 38 | ||||

| Additional Information regarding the Summary Compensation Table |

39 | |||

| 39 | ||||

| 40 | ||||

| 41 | ||||

| 42 | ||||

| 42 | ||||

| Page i |

2024 Proxy Statement |

|

| Helpful Resources

Where You Can Find More Information

Annual Meeting Information

|

| Proxy Statement: https://investors.graphicpkg.com/sec-filings/all-sec-filings

Annual Report: https://investors.graphicpkg.com/sec-filings/annual-reports

Voting Your Proxy via the Internet Before the Annual Meeting: www.proxyvote.com

Board of Directors

|

| https://investors.graphicpkg.com/corporate-governance/board-of-directors

Communications with the Board

|

| Graphic Packaging Holding Company 1500 Riveredge Parkway Atlanta, Georgia 30328 Attn: Chairman of the Board

Governance Documents

|

| https://investors.graphicpkg.com/corporate-governance/governance-documents

• Corporate Governance Guidelines

• Committee Charters

• Code of Business Conduct and Ethics

• Selected Corporate Policies and Disclosures

Investor Relations

|

| https://investors.graphicpkg.com

Sustainability

|

| https://www.graphicpkg.com/sustainability/ |

|

|

2024 Proxy Statement | Page ii |

Definition of Certain Terms or Abbreviations

| 2020 ADJUSTED EBITDA | 2020 ADJUSTED EBITDA, as defined in the 2020 grant agreements for Performance Restricted Stock Units, is consolidated net income of Graphic Packaging Holding Company before net income attributable to non-controlling interest, income tax expense, equity income of unconsolidated subsidiaries, interest expense, and depreciation and amortization, as adjusted for: expenses related to merger, acquisition and disposition activities; refinancing or early retirement of debt; acquisition integration costs; and asset or goodwill write-downs, gains or losses (including assets or businesses held for sale, but excluding inventory, receivables and write downs in the normal course of business); as well as other EBIDTA adjustments for asset retirement and disposal costs; restructuring or reorganization activities, pension settlement charges; and costs related to significant non-routine capital activities.

| |

| 2020 ROIC | 2020 ROIC or Return on Invested Capital, as defined in the 2020 grant agreements for Performance Restricted Stock Units, is consolidated net income of Graphic Packaging Holding Company before net income attributable to non-controlling interest, income tax expense, equity income of unconsolidated subsidiaries, interest expense, as adjusted for: expenses related to merger, acquisition and disposition activities, refinancing or early retirement of debt; acquisition integration costs; and asset or goodwill write-downs, gains or losses (including assets or businesses held for sale, but excluding inventory, receivables and write downs in the normal course of business); as well as other EBIDTA adjustments for asset retirement and disposal costs; restructuring or reorganization activities; pension settlement charges; and costs related to significant, non-routine capital activities (“Adjusted EBIT”) divided by Adjusted Net Debt plus adjusted Stockholder Equity, all as further adjusted for restructuring or reorganization activities.

| |

| 2023 ADJUSTED EBITDA |

As used as a performance metric for 2023 Management Incentive Plan Awards is consolidated net income of Graphic Packaging Holding Company before equity income of unconsolidated subsidiaries, interest expense, income tax expense, and depreciation and amortization, as adjusted for: expenses related to merger, acquisition and disposition activities; refinancing or early retirement of debt; acquisition integration costs; and asset or goodwill write-downs (excluding inventory, receivables and write downs in the normal course of business); as well as other EBITDA adjustments for restructuring or reorganization activities (including businesses held for sale), costs related to significant non-routine capital activities and other unusual one-time items. If the cumulative, acquired LTM Adjusted EBITDA of one or more acquisitions that was not previously included in setting the MIP performance measures exceeds $20M in the Performance Period, the performance measures will be changed to reflect the incremental increases in LTM Adjusted EBITDA over $20M. All adjustments are subject to approval by the Development Committee.

| |

| 2023 CASH FLOW BEFORE DEBT REDUCTION | As used as a performance metric for 2023 Management Incentive Plan Awards is the year-over-year change in Graphic Packaging Holding Company net debt, as adjusted for merger, acquisition, disposition, share repurchase, asset sales, dividend and capital

| |

| market activities as well as other Cash Flow Before Debt Reduction adjustments for restructuring or reorganization activities (including businesses held for sale) and other one-time unusual items. If the cumulative acquired LTM Adjusted EBITDA of one or more acquisitions that was not previously included in setting the MIP performance measures exceeds $20M in the Performance Period, the Cash Flow Before Debt Reduction performance measure will be changed to reflect the incremental increases in Cash Flow Before Debt Reduction. All adjustments are subject to approval by the Compensation and Management Development Committee.

| ||

| BOARD | The Board of Directors of Graphic Packaging Holding Company

| |

| CEO | Chief Executive Officer

| |

| CFO | Chief Financial Officer

| |

| COMPANY | Graphic Packaging Holding Company, a Delaware corporation

| |

| CRB | Coated Recycled Board

| |

| ESG | Environmental, Social and Governance Matters

| |

| FYE | Fiscal Year End

| |

| GAAP | Generally Accepted Accounting Principles in the United States

| |

| LTIR | Lost Time Injury Rate

| |

| LTIP | Long-Term Equity Incentive Program

| |

| MIP | Management Incentive Plan

| |

| NEO | Named Executive Officer

| |

| NET DEBT | Total Debt (Short-Term Debt, Long-Term Debt and Current Portion of Long-Term Debt) less Cash and Cash Equivalents

| |

| NET LEVERAGE | Net Debt divided by Adjusted EBITDA

| |

| NET ORGANIC SALES | The Company’s net sales less open market paperboard sales (Paperboard Mills Segment) less impact of purchased sales from acquisitions less impact of pricing from converting sales, including price recovery from acquisitions less impact of foreign exchange.

| |

| NYSE | New York Stock Exchange

| |

| ORGANIC REVENUE GROWTH | The percentage growth of organic revenue as defined by Net Sales – Open Market Sales – Sales from acquisitions closed within the last 12 months – FX impact.

| |

| PEO | Principal Executive Officer

| |

| PFO | Principal Financial Officer

| |

| RECORD DATE | March 25, 2024

| |

| RSU | Restricted Stock Unit

| |

| SEC | Securities and Exchange Commission

| |

| Page iii |

2024 Proxy Statement |

|

Proxy Summary

This summary provides an overview of key information in this Proxy Statement. We encourage you to read the entire Proxy Statement before voting.

ANNUAL MEETING OF STOCKHOLDERS

| Date and Time: | Thursday, May 23, 2024, 10:00 a.m. local time | |

| Location: | 1500 Riveredge Parkway Atlanta, Georgia 30328 | |

| Record Date: | March 25, 2024 | |

VOTING MATTERS

|

|

|

Board Recommendation | Page | |||

| Proposal No. 1: | Election of Directors | Vote FOR each nominee | 11 | |||

| Proposal No. 2: | Ratification of Independent, Registered Public Accounting Firm | Vote FOR ratification | 21 | |||

| Proposal No. 3: | Advisory Vote on Executive Compensation | Vote FOR approval | 49 | |||

| Proposal No. 4: | Approval of the Graphic Packaging Holding Company 2024 Omnibus Incentive Compensation Plan | Vote FOR approval | 49 | |||

| Proposal No. 5: | Simple Majority Vote | Vote AGAINST approval | 55 | |||

| CORPORATE GOVERNANCE HIGHLIGHTS

➤ Currently separate Chairman of the Board and CEO structure

➤ No Director may serve on more than three other Boards of Directors, and the CEO may serve on no more than one other public company Board of Directors

➤ Director nominees who receive a majority of withhold votes are required to resign, subject to acceptance of such resignation by the Board

➤ Board mandatory retirement age of 72

➤ Directors and senior officers are subject to stock ownership guidelines

➤ Annual stockholder vote on “Say-on-Pay”

➤ No stockholder rights plan or “poison pill”

➤ Oversight of cybersecurity risks, mitigation efforts and incident disclosures delegated to the Audit Committee

➤ Oversight of ESG expressly delegated to the Nominating and Corporate Governance Committee

➤ Oversight of diversity, equity and inclusion efforts expressly delegated to the Compensation and Management Development Committee

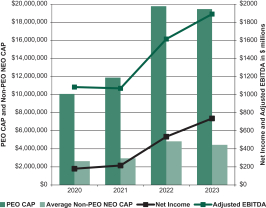

BUSINESS HIGHLIGHTS

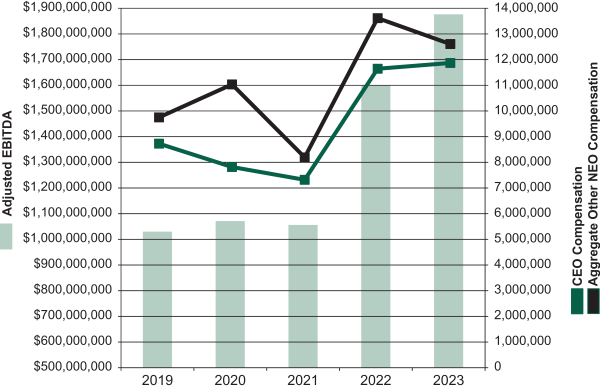

➤ Increased Net Income by 39% to $723 million versus the prior year

➤ Increased Adjusted EBITDA(1) by 17% to $1,876 million versus the prior year

➤ Reduced Net Leverage(1) to 2.8x at fiscal year end versus 3.2x at the end of the prior year

➤ Increased Earnings per Diluted Share by 38% to $2.34 |

| (1) | Adjusted EBITDA and Net Leverage are defined and reconciled to the most applicable GAAP measure in the Company’s earnings release for the fourth quarter and full year 2023, filed with the SEC as Exhibit 99 to the Company’s Report on Form 8-K filed on February 20, 2024. |

|

|

2024 Proxy Statement | Page iv |

Proxy Statement

for the

Annual Meeting of Stockholders

on

May 23, 2024

General Information

ANNUAL MEETING AND VOTING INFORMATION

This Proxy Statement is being furnished in connection with the solicitation by the Board of Graphic Packaging Holding Company of proxies to be voted at the 2024 Annual Meeting of Stockholders (the “Annual Meeting”). This Proxy Statement and the enclosed proxy card or notice of availability on the Internet will first be sent on or before April 8, 2024 to the Company’s stockholders of record as of the close of business on the Record Date. References in this Proxy Statement to the “Company,” “Graphic Packaging,” “GPHC,” “we,” “us,” and “our” or similar terms are to Graphic Packaging Holding Company.

Outstanding Shares

As of the close of business on the Record Date, there were 307,293,066 shares of the Company’s common stock outstanding and entitled to vote. Stockholders are entitled to one vote for each share held on all matters to come before the Annual Meeting.

Who May Vote

Only stockholders who held shares of the Company’s common stock at the close of business on the Record Date are entitled to notice of and to vote at the Annual Meeting or any adjournment thereof.

How Proxies Work

The Board of Directors is asking for your proxy. By giving the Board your proxy, your shares will be voted at the Annual Meeting in the manner you direct. If you do not specify how you wish to vote your shares, your shares will be voted “FOR” the election of each of the Director nominees, “FOR” the approval of the ratification of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm, “FOR” the proposal to approve the compensation paid to the Company’s named executive officers, for approval of the Graphic Packaging Holding Company 2024 Omnibus Incentive Compensation Plan, and “AGAINST” the stockholder proposal to implement a simple majority vote requirement in the Company’s organizational documents. The proxyholders will vote shares according to their discretion on any other matter properly brought before the Annual Meeting.

If for any reason any nominee for election as Director is unable or declines to serve as a Director, discretionary authority may be exercised by the proxyholders to vote for a substitute proposed by the Board.

If the shares you own are held beneficially in street name by a bank or brokerage firm, such firm, as the record holder of your shares, is required to vote your shares according to your instructions. To vote your shares, you will need to follow the directions your bank or brokerage firm provides to you. Under the rules of the NYSE, if you do not give instructions to your bank or brokerage firm, it will still be able to vote your shares with respect to certain “discretionary” items, but will not be allowed to vote your shares with respect to certain “non-discretionary” items. In the case of non-discretionary items, the shares will be treated as “broker non-votes.” Banks and brokerage firms are allowed to exercise discretionary voting authority for beneficial owners who have not provided voting instructions only with respect to Proposal 2 set forth in this Proxy Statement and not with respect to any other proposal to be voted on at the Annual Meeting.

|

|

2024 Proxy Statement | Page 1 |

General Information

How to Vote Your 401(k) Plan Shares

If you participate in the Company’s 401(k) Savings Plan or the Company’s Hourly 401(k) Savings Plan (the “401(k) Plans”), you may give voting instructions as to the number of share equivalents held in your account as of the Record Date to the trustee of the 401(k) Plans. You provide voting instructions to the trustee, Fidelity Management Trust Company, by completing and returning the proxy card accompanying this Proxy Statement. The trustee will vote your shares in accordance with your duly executed instructions if received by 11:59 p.m. Eastern Time on May 20, 2024. If you do not send instructions, the trustee will not vote the number of share equivalents credited to your account.

You may also revoke voting instructions previously given to the trustee by filing either a written notice of revocation or a properly completed and signed proxy card bearing a later date with the trustee no later than 11:59 p.m. Eastern Time on May 20, 2024. Your voting instructions will be kept confidential by the trustee.

Quorum

In order to carry out the business of the Annual Meeting, there must be a quorum. This means that at least a majority of the outstanding shares eligible to vote must be represented at the Annual Meeting, either by proxy or in person. Proxies received but marked as abstentions and broker non-votes will be included in the calculation of the number of votes present at the Annual Meeting for purposes of calculating whether a quorum is present.

Votes Needed

The Director nominees receiving the largest number of votes cast are elected, up to the maximum number of Directors fixed by the Board to be elected at the Annual Meeting. As a result, any shares not voted, whether by abstention, broker non-vote or otherwise, have no effect on the election of Directors, except to the extent that the failure to vote for a particular nominee may result in another nominee receiving a larger number of votes. However, under the Company’s Corporate Governance Guidelines, a nominee for director who receives a greater number of votes “withheld” than “for” is expected to tender his or her resignation to the Board promptly following certification of the election results. The Nominating and Corporate Governance Committee will consider any resignation tendered under this policy and recommend to the Board whether to accept or reject it. The Board will act on such resignation within 90 days following the certification of election results. A Director who tenders his or her resignation will not participate in the Nominating and Corporate Governance Committee’s recommendation or in the Board’s decision regarding whether to accept such resignation. Approval of Proposals 2, 3, 4 and 5 requires the affirmative vote of holders of a majority of the shares present in person or by proxy and entitled to vote on such matter at the Annual Meeting. An abstention with respect to these matters will have the effect of a vote against such proposal and broker non-votes will have no effect, as broker non-votes are not treated as shares entitled to vote.

Changing Your Vote

Shares of the Company’s common stock represented by proxy will be voted as directed unless the proxy is revoked. Any proxy may be revoked before it is exercised by sending an instrument revoking the proxy or a proxy bearing a later date to the Company’s Corporate Secretary. Any notice of revocation should be sent to: Graphic Packaging Holding Company, 1500 Riveredge Parkway, Atlanta, Georgia 30328, Attention: Corporate Secretary. Any proxy submitted over the Internet or by telephone may also be revoked by submitting a new proxy over the Internet or by telephone. A proxy is also revoked if the person who executed the proxy is present at the Annual Meeting and elects to vote in person.

Attending in Person

Only stockholders, their designated proxies and guests of the Company may attend the Annual Meeting. If your shares are held beneficially in street name, you must bring an account statement or letter from your brokerage firm or bank showing that you are the beneficial owner of shares of the Company’s common stock as of the Record Date in order to be admitted to the Annual Meeting.

| Page 2 |

2024 Proxy Statement |

|

General Information

Internet Availability of this Proxy Statement and Form 10-K

The Company’s Proxy Statement, 2023 Annual Report to Stockholders and 2023 Annual Report on Form 10-K are available on the Company’s website at investors.graphicpkg.com/sec-filings/all-sec-filings.

ANNUAL REPORT

The Company’s 2023 Annual Report accompanies this Proxy Statement. The Annual Report on Form 10-K for the fiscal year ended December 31, 2023 for GPHC is included in the Annual Report and is available without charge upon written request addressed to Graphic Packaging Holding Company, Investor Relations, 1500 Riveredge Parkway, Atlanta, Georgia 30328. The Company will also furnish any exhibit to the Annual Report on Form 10-K for the fiscal year ended December 31, 2023, if specifically requested.

|

|

2024 Proxy Statement | Page 3 |

Corporate Governance Matters

INFORMATION REGARDING THE BOARD OF DIRECTORS

Members, Standing Committees and Meetings of the Board of Directors

The table below shows the current members and chairs of the Board of Directors and each standing committee of the Board, the tenure and independence status of each Board member, the Audit Committee Financial Expert status of the members of the Audit Committee and the number of Board and committee meetings held during 2023.

| Director |

Tenure on Board of Directors |

Board of Directors |

Audit Committee |

Compensation and Management Development Committee |

Nominating and Corporate Governance Committee | |||||||

| Aziz Aghili* |

2.1 Years | ● | ● | ● |

| |||||||

| Laurie Brlas |

5.2 Years | ● |

|

● | ● | |||||||

| Michael P. Doss# |

8.9 Years | ● |

|

|

| |||||||

| Robert A. Hagemann* |

9.9 Years | ● | ● |

|

● | |||||||

| Philip R. Martens |

10.4 Years | C |

|

|

C | |||||||

| Mary K. Rhinehart* |

3.1 Years | ● | ● | ● |

| |||||||

| Dean A. Scarborough* |

5.7 Years | ● | ● | ● |

| |||||||

| Larry M. Venturelli* |

7.9 Years | ● | C |

|

● | |||||||

| Lynn A. Wentworth |

14.4 Years | ● |

|

C | ● | |||||||

| Number of Meetings |

|

|

|

5 | 7 | 5 | 3 | |||||

● Member C Chair # Non Independent * Financial Expert

| Q. | How does Graphic Packaging determine which Directors are independent? |

| A. | For purposes of this Proxy Statement, “independent” and “independence” have the meanings set forth under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the rules and regulations adopted thereunder by the SEC, the corporate governance listing standards of the NYSE, and the Company’s Corporate Governance Guidelines, all as in effect from time to time. A Director will not qualify as independent unless the Board affirmatively determines that the Director has no material relationship with the Company (either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company). In addition, in accordance with the corporate governance listing standards of the NYSE, the Company will also apply the following standards in determining whether a Director is independent: |

| • | A Director who is an employee of the Company, or whose immediate family member serves as one of the Company’s executive officers, may not be deemed independent until three years after the end of such employment relationship. |

| • | A Director who receives, or whose immediate family member receives, more than $120,000 per year in direct compensation from the Company, other than Board and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service), may not be deemed independent until three years after he or she ceases to receive more than $120,000 per year in such compensation. Compensation received by a director for former service as an interim Chairman or Chief Executive Officer or other executive officer or compensation received by an immediate family member for service as one of the Company’s non-executive employees will not be considered in determining independence under this test. |

| • | A Director who is a partner or employee of a firm that is the Company’s internal or external auditor or whose immediate family member is a partner of such a firm or is a current employee of such a firm and personally works on the Company’s audit may not be deemed independent until three years after the end of the affiliation or the employment or auditing relationship. |

| Page 4 |

2024 Proxy Statement |

|

Corporate Governance Matters

| • | A Director who is employed, or whose immediate family member is employed, as an executive officer of another company where any of the Company’s current executive officers at the same time serve on that company’s compensation committee may not be deemed independent until three years after the end of such service or the employment relationship. |

| • | A Director who is an employee, or whose immediate family member is an executive officer of a company that makes payments to, or receives payments from the Company for property or services in an amount which, in any single fiscal year, exceeds the greater of $1 million or 2% of such other entity’s consolidated gross revenues, may not be deemed independent until three years after falling below that threshold. |

Applying these standards, the Board of Directors determined that all of the Company’s Directors who served in 2023 were independent except Mr. Doss. Mr. Doss is not considered independent because he serves as an executive officer of the Company.

| Q. | What is the leadership structure of the Board of Directors? |

| A. | Pursuant to the Company’s By-Laws, the Chairman of the Board of Directors is elected from time to time by the members of the Board of Directors. The By-Laws do not require, and the Board of Directors does not have a specific policy with respect to, the separation of the roles of the Chairman of the Board and the Chief Executive Officer. The By-Laws provide that the Chairman of the Board shall preside over each meeting of the stockholders of the Company and the Board of Directors and may have other duties and powers as conferred upon the Chairman by the Board of Directors. In accordance with the Company’s Corporate Governance Guidelines, if the Chairman of the Board is the Chief Executive Officer, the independent directors are required to elect one independent director to serve as Lead Director. The Lead Director is responsible for, among other duties, assisting the Chairman in providing Board leadership and presiding over the regular executive sessions of the Board at which non-management Directors meet without management participation. |

| Mr. Philip A. Martens was elected by the Board to serve as Chairman on May 25, 2016, and has served as Chairman since that time. The Board believes that having an independent Board member serve as Chairman currently is appropriate. The Board believes that separating the roles of the Chairman and CEO is beneficial in part because it provides additional resources for managing the Board’s functions, as well as experienced, independent oversight of management. In general, our Chairman of the Board will work with our CEO and other Board members to determine the Board’s strategic priorities, while the CEO will be responsible for communicating the Board’s guidance to management and implementing the Company’s key strategic initiatives. |

| Q. | Did any of the Company’s Directors attend fewer than 75% of the meetings of the Board and their assigned committees? |

| A. | No. All of the Company’s Directors attended at least 88% of the meetings of the Board and their assigned committees during 2023. |

| Q. | What is the Company’s policy on Director attendance at annual meetings of stockholders? |

| A. | Directors are expected to attend each annual meeting of stockholders but are not required to do so. All of the Company’s Directors attended the 2023 annual meeting of stockholders. |

| Q. | Do the non-management Directors meet during the year in executive session? |

| A. | Yes, the non-management Directors met separately at regularly scheduled executive sessions during 2023 without any member of management being present. Mr. Martens, as Chairman, acted as the presiding Director at each executive session held by the Board. |

| Q. | What does the Audit Committee do? |

| A. | The purpose of the Audit Committee is to assist the Board in overseeing the financial matters of the Company, such as the Company’s financial statements, internal and independent auditors and audits, and other areas such |

|

|

2024 Proxy Statement | Page 5 |

Corporate Governance Matters

| as legal and regulatory compliance that directly impact the Company’s financial and risk profile. The Committee is responsible for, among other things, assisting the Board in its oversight of: |

| • | the integrity of the Company’s financial statements; |

| • | compliance with legal and regulatory requirements; |

| • | systems of internal accounting and financial controls; |

| • | the performance of the annual independent audit of the Company’s financial statements; |

| • | the Company’s independent auditor’s qualifications and independence; |

| • | the performance of the internal audit function; |

the review and approval or ratification (if appropriate) of transactions with related parties; and

| • | the status of the Company’s information security, controls, and reporting. |

| The Audit Committee is also responsible for preparing the Report of the Audit Committee in conformity with the rules of the SEC to be included in the proxy statement for the annual meeting of stockholders. |

| Q. | What does the Compensation and Management Development Committee do? |

| A. | The purpose of the Compensation and Management Development Committee is to ensure that the Company’s compensation, integrated talent management, and diversity, equity and inclusion programs support the growth and success of the Company without creating incentives that encourage unnecessary risk-taking. Specifically, the Compensation and Management Development Committee does the following: |

| • | review and approve all compensation plans or programs in which the CEO and the other executive officers participate; |

| • | review and approve all equity compensation plans; |

| • | evaluate the alignment between compensation philosophy, plan design and achievement of short and long-term financial and other results, including the development of a growth-oriented culture; |

| • | review the Company’s compensation practices, policies and programs for executive officers and other employees to ensure that they do not encourage unnecessary or excessive risk-taking; |

| • | annually review the Company’s integrated talent management processes and diversity, equity and inclusion programs; |

| • | facilitate the Board’s review of CEO succession planning; |

| • | direct the annual process for evaluating the CEO’s performance and compensation; |

| • | annually review and approve all compensation arrangements of the executive officers; |

| • | evaluate and approve awards of restricted stock units or other types of equity compensation; |

| • | review the Company’s retirement and savings plans from time to time; and |

| • | annually review compliance with the executive stock ownership requirements and clawback policy. |

| Q. | Did the Compensation and Management Development Committee engage a compensation consultant to assist it in making recommendations to the Board of Directors regarding the amount or form of compensation paid to executive officers? |

| A. | Yes, the Compensation and Management Development Committee engaged Willis Towers Watson US LLC (“WTW”) to serve as an independent compensation advisor to the Compensation and Management Development Committee. Representatives from WTW attended Compensation and Management Development Committee meetings and advised the Compensation and Management Development Committee on compensation trends, best practices and regulatory compliance issues, in addition to providing executive compensation benchmarking analysis. While representatives from WTW work with members of management to |

| Page 6 |

2024 Proxy Statement |

|

Corporate Governance Matters

| collect information and prepare materials for the Compensation and Management Development Committee and assisted the Company in its compliance with the Pay versus Performance rules and calculations, such representatives report directly to the Compensation and Management Development Committee and the decision to retain WTW is made solely by the Compensation and Management Development Committee. |

| Q. | Did WTW provide any services other than executive compensation advisory services in 2023? |

| A. | WTW was hired primarily to assist the Compensation and Management Development Committee in its review of executive compensation practices, including regulatory compliance issues. During 2023, WTW also provided information and support to the Committee and the Company with respect to calculation of the Total Stockholder Return (“TSR”) metric applicable to Performance-Based RSUs, the Pay versus Performance rules and calculations, market data and analysis for senior management positions other than the NEOs, market data and analysis for the Nominating and Corporate Governance Committee regarding compensation for non-employee directors, and access to ongoing education on a wide range of compensation and benefits topics. |

| Q. | Does the Company have compensation policies and practices that create risks that are reasonably likely to have a material adverse effect on the Company? |

| A. | No, the Company does not believe its compensation policies and practices for its employees create risks that are reasonably likely to have a material adverse effect on the Company. The Company uses performance measures in its short-term and long-term incentive programs that encourage employees to focus on achieving Company-wide profitability and strategic goals. In addition, the design and payout of the Company’s incentive programs are reviewed annually by the Company’s compensation consultant for provisions or practices that might encourage unnecessary or excessive risk-taking and are subject to the review and approval of the Compensation and Management Development Committee and, with respect to the compensation of the President and CEO, the full Board of Directors. |

| Q. | Does the Compensation and Management Development Committee have any interlocks with other compensation committees? |

| A. | Ms. Brlas, Ms. Rhinehart and Ms. Wentworth, as well as Messrs. Aghili and Scarborough served as members of the Compensation and Management Development Committee during 2023. None of these members is or has ever been an officer or employee of the Company. No member had any relationship requiring disclosure as a compensation committee interlock during 2023. |

| Q. | What does the Nominating and Corporate Governance Committee do? |

| A. | The Nominating and Corporate Governance Committee is responsible for, among other things, identifying qualified individuals for nomination to the Board, recommending new members to the Board, providing orientation and training for new directors, developing and recommending a set of corporate governance principles to the Board, and overseeing the annual evaluations of the Board and its committees and management. In addition, the Nominating and Corporate Governance Committee is responsible for reviewing the Company’s policies and practices for consistency with its responsibility for ESG matters and oversees the Company’s ESG programs and publications. |

| Q. | What steps does the Board take to exercise its oversight responsibility for the Company’s strategic direction and progress toward achieving its Vision 2030 financial and sustainability goals? |

| A. | The Board reviews the Company’s strategic direction and initiatives each year when it reviews and approves the Company’s long-range plan. The Board will review and evaluate the Company’s progress toward achieving its Vision 2030 sustainability goals each year when it reviews and approves the annual operating plan. In addition, each of the standing committees of the Board reviews and evaluates specific financial, operational and reputational risks that could affect the Company’s ability to meet its financial and sustainability goals. |

|

|

2024 Proxy Statement | Page 7 |

Corporate Governance Matters

BOARD AND COMMITTEE OVERSIGHT OF RISK MANAGEMENT

| Full Board

As set forth in the Company’s Corporate Governance Guidelines, the Board is responsible for reviewing, approving and monitoring business strategies and financial performance, and ensuring processes are in place for maintaining the integrity of the Company in financial reporting, legal and ethical compliance matters, and in relationships with customers, suppliers, employees, the community and stockholders. The Board fulfills these responsibilities through a number of different practices, including the approval of each annual operating plan and long-term strategic plan, the review of actual results against such plans at each regular Board meeting, and specific review and approval of significant corporate actions such as acquisitions and divestitures, plant rationalizations and major projects involving significant capital spending. In addition, the Board oversees areas of particular risk through its Audit Committee, Compensation and Management Development Committee and Nominating and Corporate Governance Committee, each of which provides a report to the full Board of Directors at each regular Board meeting. | ||||||||

|

|

|

| ||||||

|

Audit Committee

The Audit Committee has oversight responsibility for the quality and integrity of the Company’s financial statements, the performance of the Company’s internal audit function and the Company’s compliance with legal and regulatory requirements. To fulfill these responsibilities, the Audit Committee routinely discusses and evaluates (i) audit findings and issues with the Company’s Chief Financial Officer and independent auditors, (ii) internal controls, processes and issues with the Company’s Senior Vice President and Chief Audit Risk and Compliance Officer (who reports directly to the Chairman of the Audit Committee and the Chief Financial Officer), (iii) legal and regulatory compliance issues with the Company’s Executive Vice President, General Counsel and Secretary, and (iv) the status of the Company’s information security and controls with the Company’s Chief Information Officer. The Committee also periodically reviews and evaluates the Company’s policies with respect to risk assessment and risk management, including discussion of the Company’s major financial risk exposures and the steps that management has taken to monitor and control such exposures. The Board has also delegated to the Audit Committee oversight responsibility for the Company’s information security, controls and reporting. In addition to these activities, the Audit Committee reviews each of the Company’s Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q and has the opportunity to discuss such reports with management of the Company and the Company’s independent auditors prior to the filing of such reports with the SEC.

|

Compensation and Management Development Committee

The Compensation and Management Development Committee has oversight responsibility for any risks to the Company inherent in the structure of the Company’s compensation programs for its employees. Pursuant to its Charter, the Compensation and Management Development Committee reviews and approves the Company’s general compensation philosophy, incentive and equity compensation plans, health and welfare plan offerings and retirement and savings plans for all employees to ensure that they do not encourage unnecessary or excessive risk-taking. In addition, the Compensation and Management Development Committee reviews and approves all compensation arrangements and awards relating to the Company’s executive officers, with all compensation arrangements of the President and CEO of the Company being reviewed and approved for recommendation to the full Board of Directors for final approval. Through its review of these programs and arrangements, as well as its oversight of the Company’s diversity, equity and inclusion programs and talent management and succession practices, the Compensation and Management Development Committee and the Board has visibility into and exercises oversight over the financial and other risks, such as retention of key management and ability to recruit necessary talent, affected by the Company’s compensation and benefits programs. |

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee has oversight responsibility for Board and Committee succession, as well as Board members’ and Board and Committee Chair compensation. In addition, the Nominating and Corporate Governance Committee reviews and recommends policies and practices such as the stockholding guidelines for directors and senior executives. The Nominating and Corporate Governance Committee also reviews the Company’s policies and practices for consistency with its responsibility for ESG matters and oversees the Company’s ESG programs and publications, such as the annual ESG report. | ||||||

| Page 8 |

2024 Proxy Statement |

|

Corporate Governance Matters

OVERSIGHT OF ESG MATTERS

ESG matters inform our decisions about how we operate and grow our business, protect our environment and support our employees. In recognition of the importance of ESG matters to the Company, we believe that a two-tiered level of oversight provides the best structure to integrate consideration of ESG risks and opportunities into our overall business strategy and help us meet the changing demands of all our stakeholders – stockholders, customers, employees and communities. Our Board of Directors is responsible for the oversight of our sustainability strategy, governance standards, goals and performance and has assigned principal oversight of our sustainability policy and practices to the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee considers current and emerging social and environmental trends, as well as major legislative and regulatory developments and other public policy issues that may impact our business operations or stakeholders. The Committee also reviews the Company’s policy and practices for consistency with its ESG commitments, including goals, performance metrics, and public reporting and makes recommendations to the Board and management. In addition, oversight of governance matters such as enterprise risk management and cybersecurity risk are assigned to the Audit Committee, while oversight of a range of human capital and social matters related to the effective recruitment, development and retention of the diverse talent necessary to support the long-term success of the Company is the responsibility of the Compensation and Management Development Committee.

In October 2023, the Company published its 2022 ESG Report, which is available on the Company’s website at www.graphicpkg.com/documents/2023/09/2022-esg-report.pdf/. In addition, the Company was recognized for the second year in a row by Fortune as one of the world’s most admired companies, received validation by the Science Based Target Initiative on the Company’s new greenhouse gas reduction targets and reaffirmed its commitment as a participant in the UN Global Compact.

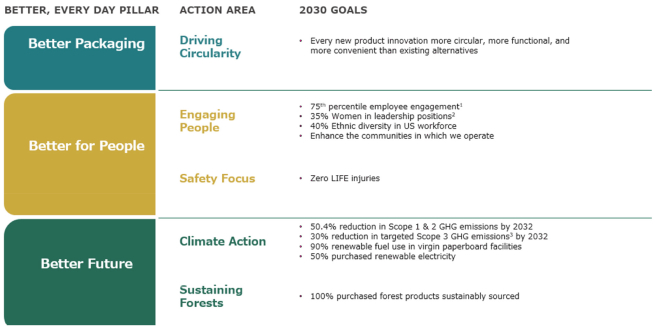

In February 2024, the Company launched its Vision 2030 Sustainability Goals, which are set forth below.

2030 Sustainability Action Plan

We encourage you to visit our website at https://www.graphicpkg.com/sustainability/ and review our recent ESG report to learn more about our progress in advancing our sustainability goals.

| 1 | Defined as Vice President level and above. |

| 2 | Measured using Gallop Q12. |

| 3 | Includes Scope 3 Category 1, 3, 4, 5, 10 and 12 emissions. |

|

|

2024 Proxy Statement | Page 9 |

Corporate Governance Matters

OVERSIGHT OF DIVERSITY, EQUITY AND INCLUSION EFFORTS

The Company’s greatest asset is its people, and to deliver on our business commitments requires attracting, developing and retaining talented individuals with different capabilities, ideas and experiences. The Board is one of the driving forces behind creating a culture of diversity, equity and inclusion (DEI) and actively reviews the Company’s processes and practices related to workforce DEI programs and initiatives to drive equitable treatment of employees and a culture of inclusion. The Company has a multi-year DEI strategy to foster an environment where we value differences and allow each person to bring their authentic selves to work, creating a sense of belonging. A key enabler of this strategy is the GPI Inclusion Council members who serve as agents of change and proactively promote DEI as part of our core values, ensuring that we make measurable progress toward our DEI goals. In 2023, the Company expanded our Employee Resource Groups, launching Pride+ and Global Veterans and Military Advocates. DEI education and awareness creation was also a key focus in 2023, as we rolled out various learning opportunities reaching a global population of leaders.

Our employees play a crucial role in achieving our vision and we look to them for their insights and feedback on how they perceive our culture and potential areas for improvement. To leverage this resource, in 2023 we conducted a global employee engagement survey in partnership with Gallup, resulting in 78% of our employees sharing their voice. Results of this survey were shared with our entire employee population and also with our Board, which takes a strong interest in understanding employee feedback and helping to guide strategy to continually improve the employee experience. Action plans have been created at the local level in many of our facilities around the globe to identify and execute opportunities to strengthen employee engagement.

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

The Board recognizes that Related Party Transactions (as defined below) can present potential or actual conflicts of interest and create the appearance that Company decisions are based on considerations other than the best interests of the Company and its stockholders. In March 2007, the Board of Graphic Packaging Corporation (the publicly-traded predecessor to the Company, “GPC”) delegated authority to the Audit Committee to review and approve Related Party Transactions, and the Audit Committee has adopted a Policy Regarding Related Party Transactions.

The Policy Regarding Related Party Transactions defines a “Related Party Transaction” as any transaction, arrangement or relationship (including any indebtedness or guarantee of indebtedness) in which (a) the aggregate amount involved will or may be expected to exceed $120,000 in any fiscal year, (b) the Company is a participant, and (c) any Related Party (as defined below) has or will have a direct or indirect interest, other than an interest that arises solely as a result of being a director or beneficial owner of less than 10% of another entity. The policy defines a “Related Party” as any (a) person who is or was since the beginning of the last fiscal year an executive officer, director or nominee for election as a director of the Company, (b) any beneficial owner of more than 5% of the Company’s common stock, (c) an immediate family member of any of the foregoing, or (d) any firm, corporation or other entity in which any of the foregoing is employed, is a principal or serves in a similar position, or has a beneficial ownership of more than 5%.

The Policy Regarding Related Party Transactions provides that the Audit Committee shall review all of the material facts and circumstances of all Related Party Transactions and either approve, ratify or disapprove of the entry into the Related Party Transaction. In determining whether to approve a Related Party Transaction, the Audit Committee will take into account, among other factors it deems appropriate, whether the Related Party Transaction is on terms no less favorable than terms generally available to an unaffiliated third-party under the same or similar circumstances, the benefits to the Company, the extent of the Related Party’s interest in the transaction, and if the Related Party is a director or a nominee for director, the impact on such director’s independence. The policy provides that certain Related Party Transactions, including certain charitable contributions, transactions involving competitive bids and transactions in which all stockholders receive proportional benefits, are pre-approved and do not require an individual review by the Audit Committee. You may find a copy of the Policy Regarding Related Party Transactions on the Company’s website at www.graphicpkg.com/corporate-governance/governance-documents.

GOVERNANCE DOCUMENTS

The Company will provide printed copies of the charters of the Audit Committee, Compensation and Management Development Committee and Nominating and Corporate Governance Committee, as well as the Policy Regarding Related Party Transactions, the Code of Business Conduct and Ethics and the Corporate Governance Guidelines to any person without charge upon request.

| Page 10 |

2024 Proxy Statement |

|

Proposal 1 — Election of Directors

The Company’s Board of Directors currently has nine members divided into three classes, with one class being elected each year for a three-year term. The three nominees standing for election as Class II Directors are: Messrs. Aghili and Martens and Ms. Wentworth.

If elected, each Class II nominee will serve three consecutive years with the term expiring in 2027 and until a successor is elected and qualified. The election of the Director nominees is by plurality vote, which means that the three nominees receiving the highest number of affirmative votes will be elected. Under the Company’s Corporate Governance Guidelines, any nominee who receives a greater number of votes “withheld” than “for” votes in an uncontested election is expected to tender to the Board his or her resignation as a Director promptly following certification of the election results. The Nominating and Corporate Governance Committee will then consider such resignation and recommend to the Board whether to accept or reject it and the Board will act on such resignation within 90 days following the certification of election results.

If at the time of the Annual Meeting, any of the nominees identified below is unable or unwilling to serve as a Director for any reason, which is not expected to occur, the persons named as proxies will vote for such substitute nominee or nominees, if any, as shall be designated by the Board.

Set forth below is certain information regarding the Director nominees and each of the incumbent Directors whose term will continue after the Annual Meeting, including the particular experience, qualifications and skills that led the Board to conclude that the Director nominee or incumbent Director is qualified to serve as a Director of the Company. There are no family relationships among any Directors or executive officers of the Company.

INFORMATION CONCERNING THE NOMINEES

Class II Directors — Terms to Expire in 2027

|

Aziz Aghili

Executive |

Biographical Information: Aziz Aghili, 65, joined the Company’s Board on March 1, 2022. Mr. Aghili serves as Executive Vice President and President, Heavy Vehicle Group of Dana Incorporated, a global leader in drivetrain and e-propulsion systems for commercial and industrial vehicles. Mr. Aghili joined Dana Incorporated in 2009 as President of Dana Europe, before being named President of Dana Asia-Pacific in 2010, President of Off Highway Driveline Technologies in 2011, Executive Vice President and President of Highway Driveline Technologies in 2012, and to his present position in 2021. During his time with Dana, Mr. Aghili has also led the company’s Global Aftermarket group. Prior to joining Dana Incorporated, Mr. Aghili spent more than 20 years at Meritor, where he most recently served as Vice President and General Manager of Body Systems, a $1.4 billion division with 24 global manufacturing facilities based in Europe. Additionally, he held strategic leadership positions around the world, including Vice President and General Manager of Asia Pacific and Vice President of Global Procurement, Commercial Marketing, and Business Development – Asia Pacific. Mr. Aghili also spent several years in the U.S., Malaysia, and Australia. Before joining Meritor, he worked for Nissan Motor Company and General Electric Plastics. Mr. Aghili is a member of the Board of Directors of Columbus McKinnon Corporation.

Qualifications: The Board concluded that Mr. Aghili is qualified to serve as a Director of the Company because he has over 30 years of experience managing manufacturing businesses and has extensive international business experience, particularly in Europe and Asia. In addition, Mr. Aghili has served on the Board of Directors of another public company, Columbus McKinnon Corporation for over three years.

| |

|

|

2024 Proxy Statement | Page 11 |

Proposal 1 — Election of Directors

|

Philip R. Martens

Former President Officer, Novelis Inc.

|

Biographical Information: Philip R. Martens, 63, was appointed Chairman of the Company’s Board of Directors on May 25, 2016. He joined the Company’s Board on November 21, 2013. Mr. Martens is the former President and Chief Executive Officer of Novelis Inc., a rolled aluminum manufacturing company, and he served in this capacity from 2009 to 2015. Prior to his employment with Novelis, Mr. Martens served as Senior Vice President of light vehicle systems for ArvinMeritor Inc., a distributor for engine and transmission parts, and President and Chief Executive Officer designate of Arvin Innovation, a leading global provider of dynamic motion and control automotive systems. Prior to that, Mr. Martens served as President and Chief Operations Officer of Plastech Engineered Products. From 1987 to 2005, he held various engineering and leadership positions at Ford Motor Company, most recently serving as group Vice President of product creation. Mr. Martens is also Chairman of the Board of International Automotive Components.

Qualifications: The Board concluded that Mr. Martens is qualified to serve as a Director of the Company because he has over 25 years of senior management experience, including serving as Chief Executive Officer of two public manufacturing companies, including a company which is significantly larger than Graphic Packaging Holding Company. Mr. Martens also has extensive experience in international operations and business in Europe, South America and Asia where the Company currently has operations.

| |

|

Lynn A.

Former Senior Vice

|

Biographical Information: Lynn A. Wentworth, 65, joined the Company’s Board on November 18, 2009. Ms. Wentworth is the former Senior Vice President, Chief Financial Officer and Treasurer of BlueLinx Holdings, Inc., a building products distributor, where she served from January 2007 until February 2008. Prior to joining BlueLinx, she was, most recently, Vice President and Chief Financial Officer for BellSouth Corporation’s Communications Group and held various other positions there from 1985 until 2007. She is a certified public accountant. Ms. Wentworth was elected to the Board of Directors of Benchmark Electronics, Inc. on June 25, 2021, and to the Board of Directors of Lineage, Inc., a privately-held cold storage REIT on July 1, 2022. She currently serves as the Chair of the Audit Committee of Lineage Inc. and Benchmark Electronics, Inc., and is the former Chairman of the Board of Cincinnati Bell, Inc. and Cyrus One, Inc., where she also previously served as the Chair of the Audit and Finance Committees for both companies.

Qualifications: The Board concluded that Ms. Wentworth is qualified to serve as a Director of the Company because she has over 30 years of public accounting and corporate finance experience, including her service as the Chief Financial Officer of BlueLinx Holdings, Inc., a public company, and the Communications Group of BellSouth Corporation, as well as her extensive board and corporate governance experience.

| |

| Page 12 |

2024 Proxy Statement |

|

Proposal 1 — Election of Directors

INFORMATION REGARDING CONTINUING DIRECTORS

Class III Directors — Terms to Expire in 2025

|

Laurie Brlas

Former Executive

|

Biographical Information: Laurie Brlas, 66, joined the Company’s Board on January 11, 2019. In December 2016, Ms. Brlas retired from Newmont Mining Corporation (“Newmont”), a mining industry leader in value creation and sustainability. Ms. Brlas joined Newmont in 2013 and served as Executive Vice President and Chief Financial Officer until October 2016. From 2006 through 2013, Ms. Brlas held various positions of increasing responsibility with Cliffs Natural Resources, most recently she served as Chief Financial Officer and then as Executive Vice President and President, Global Operations. Prior to that, Ms. Brlas served as Senior Vice President and Chief Financial Officer of STERIS Corporation from 2000 through 2006 and from 1995 through 2000, Ms. Brlas held various positions of increasing responsibility with Office Max, Inc. Most recently, Ms. Brlas served as Senior Vice President and Corporate Controller. Ms. Brlas currently serves on the Board of Directors of Albemarle Corporation, a specialty chemical company, Constellation Energy Corp., an energy company, and Autoliv, Inc., a global automotive safety supplier.

Qualifications: The Board concluded that Ms. Brlas is qualified to serve as a Director of the Company because of her previous executive leadership roles at several large public companies, including serving as Executive Vice President and Chief Financial Officer of Newmont Mining Corporation, a $7.3 billion mining company, as well as her extensive board and corporate governance experience on a number of public boards of directors.

| |

|

Robert A.

Former Senior Vice

|

Biographical Information: Robert A. Hagemann, 67, joined the Company’s Board on May 21, 2014. Mr. Hagemann, who is currently retired, was most recently Senior Vice President and Chief Financial Officer of Quest Diagnostics Incorporated (“Quest”) from May 2003 to July 2013. Prior to that, Mr. Hagemann served as Vice President and Chief Financial Officer of Quest from August 1998. Mr. Hagemann joined a predecessor company, Corning Life Sciences, Inc. (“Corning”), a subsidiary of Quest’s former parent, Corning Incorporated, in 1992, and held a variety of senior financial positions before being named Vice President and Corporate Controller of Quest in 1996. Prior to joining Corning, Mr. Hagemann was employed by Prime Hospitality, Inc. and Crompton & Knowles, Inc. in senior financial positions. He was also previously employed by Arthur Young & Co., a predecessor company to Ernst & Young. Mr. Hagemann serves on the Board of Directors of Zimmer Biomet Holdings, Inc. and Ryder System, Inc.

Qualifications: The Board concluded that Mr. Hagemann is qualified to serve as a Director of the Company because of his 15 years of experience as the Chief Financial Officer of Quest Diagnostics, as well as his experience as a board member of both Zimmer Biomet Holdings, Inc. and Ryder System, Inc. Mr. Hageman serves as Chairman of the Audit Committee and a member of the Corporate Governance Committee for Zimmer Biomet Holdings, Inc. In addition, Mr. Hagemann serves as a member of the Audit Committee and the Finance Committee for Ryder System, Inc. Mr. Hagemann also has extensive acquisition experience, having completed and integrated numerous acquisitions over the course of his career.

| |

|

|

2024 Proxy Statement | Page 13 |

Proposal 1 — Election of Directors

|

Mary K.

Chairman of the

|

Biographical Information: Mary K. Rhinehart, 65, joined the Company’s Board on February 16, 2021. Ms. Rhinehart is the Chair of the Board of Johns Manville, a Berkshire Hathaway company and a global manufacturer of premium quality building and specialty products. Ms. Rhinehart has worked at Johns Manville for over four decades, serving in leadership roles in finance, global treasury, global supply chain, human resources and strategic business development, most recently serving as President and Chief Executive Officer and Chair from 2014 to 2020. Prior to that, Ms. Rhinehart served as Chief Financial Officer from 2004 to 2012. She has run several business units with full P&L responsibilities. Ms. Rhinehart currently serves as a non-executive director for CRH plc, a diversified building materials business, and Chair of Lubrizol, a global specialty chemical company, also a Berkshire Hathaway company.

Qualifications: The Board concluded that Ms. Rhinehart is qualified to serve as a Director of the Company because she has extensive finance and executive leadership experience, as well as over seven years of experience as the Chairman of the Board of a global manufacturing company with revenues of over $3 billion.

| |

Class I Directors — Terms to Expire in 2026

Michael P. Doss

President and Chief

|

Biographical Information: Michael P. Doss, 57, is the President and Chief Executive Officer of the Company. He was elected to the Board of Directors on May 20, 2015. Prior to January 1, 2016, Mr. Doss held the position of President and Chief Operating Officer from May 20, 2015 through December 31, 2015 and Chief Operating Officer from January 1, 2014 until May 19, 2015. Prior to these positions, he served as the Executive Vice President, Commercial Operations of the Company. Prior to this, Mr. Doss held the position of Senior Vice President, Consumer Packaging Division. Prior to March 2008, he served as Senior Vice President, Consumer Products Packaging of Graphic Packaging Corporation since September 2006. From July 2000 until September 2006, he was the Vice President of Operations, Universal Packaging Division. Mr. Doss was Director of Web Systems for the Universal Packaging Division prior to his promotion to Vice President of Operations. Since joining Graphic Packaging International Corporation in 1990, Mr. Doss has held positions of increasing management responsibility, including Plant Manager at the Gordonsville, TN and Wausau, WI plants. Mr. Doss serves on the Board of Directors for the American Forest & Paper Association, the Sustainable Forest Initiative, the Paper Recycling Coalition, the Atlanta Area Council of the Boy Scouts of America, the Metro Atlanta Chamber of Commerce, the Woodruff Arts Center, the American Bird Conservancy, and Regal Rexnord Corporation (RRX).

Qualifications: The Board concluded that Mr. Doss is qualified to serve as a Director of the Company because of his detailed knowledge of the Company and its business, having served in various senior management and operational roles with the Company or its predecessors since 1990. Mr. Doss also has significant financial management training, as he received a Master of Business Administration degree in Finance from Western Michigan University and has had supervisory responsibility for the Chief Financial Officer since becoming the President and Chief Executive Officer of Graphic Packaging Holding Company in January 2016.

| |

| Page 14 |

2024 Proxy Statement |

|

Proposal 1 — Election of Directors

|

Dean A.

Former Chief

|

Biographical Information: Dean A. Scarborough, 68, joined the Company’s Board on July 27, 2018. In May 2016, Mr. Scarborough retired as Chief Executive Officer of Avery Dennison Corporation (“Avery”), a leader in packaging and labeling solutions with $6 billion in annual sales. Mr. Scarborough joined Avery in 1983 and served in a series of positions of increasing responsibility. In 1990, he was promoted to Vice President and General Manager of Label and Packaging Materials’ North American division. Five years later, he moved to the Netherlands and led Label and Packaging Materials Europe. Returning to the U.S. in 1997, he was appointed group Vice President, Label and Packaging Materials North America and Labels and Packaging Materials Europe. Two years later, he was promoted to group Vice President, Label and Packaging Materials Worldwide. In 2000, he was elected President and Chief Operating Officer. From 2005 until his retirement in 2016, Mr. Scarborough served as President and Chief Executive Officer and as Chairman of the Board from 2010 to 2016. He retired as Chairman of the Board of Avery in 2019. Additionally, Mr. Scarborough was on the Board of Directors of Cardinal Health, Inc. until November 7, 2022, and currently serves as a director of Beontag, Inc.

Qualifications: The Board concluded that Mr. Scarborough is qualified to serve as a Director of the Company because he recently completed more than 11 years of service as the Chief Executive Officer of Avery Dennison Corporation, a publicly-traded packaging and labeling solutions company with approximately $6 billion in annual sales, and also formerly served as the Chairman of the Board of Directors of such Company. In addition, Mr. Scarborough served for over ten years on the Board of Directors of Mattel, Inc., the world’s largest toy brand. He brings extensive experience in building brand and stockholder value to the Company.

| |

|

Larry M.

Former Executive

|

Biographical Information: Larry M. Venturelli, 63, joined the Company’s Board on May 25, 2016. Mr. Venturelli is the former Executive Vice President and Chief Financial Officer of Whirlpool Corporation, the world’s leading global manufacturer of home appliances, and he served in this capacity from January 2012 to August 2016, retiring from the company in February 2017. He joined Whirlpool as Assistant Corporate Controller in 2002. He held a number of positions of increasing leadership accountability in the Investor Relations and Global Finance organizations, serving as Senior Vice President, Corporate Controller, Chief Accounting Officer and Chief Financial Officer for Whirlpool International. Prior to joining Whirlpool, Mr. Venturelli held various financial positions at Royal Caribbean Cruises, Campbell Soup Company and Quaker Oats.

Qualifications: The Board concluded that Mr. Venturelli is qualified to serve as a Director of the Company because he has over 30 years of corporate finance experience, including approximately five years of experience as the Chief Financial Officer and 4 years as the Corporate Controller of Whirlpool Corporation, a U.S. manufacturing company with revenues exceeding $20 billion. In addition, Mr. Venturelli has 16 years of experience working for U.S. food products companies and has served as the head of Investor Relations.

| |

|

|

2024 Proxy Statement | Page 15 |

Proposal 1 — Election of Directors

CRITERIA FOR POTENTIAL DIRECTORS

The Company’s Board is responsible for selecting nominees for election as Directors by stockholders and for filling vacancies on the Board. The Nominating and Corporate Governance Committee is responsible for identifying and recommending to the Board individuals for nomination as members of the Board and its committees and, in this regard, reviewing with the Board on an annual basis the current skills, background and expertise of the members of the Board, as well as the Company’s future and ongoing needs. This assessment is used to establish criteria for identifying and evaluating potential candidates for the Board. However, as a general matter, the Nominating and Corporate Governance Committee seeks individuals with significant and relevant business experience who demonstrate:

| • | the highest personal and professional integrity; |

| • | commitment to driving the Company’s success; |

| • | an ability to provide informed and thoughtful counsel on a range of issues; and |

| • | exceptional ability and judgment. |

The Nominating and Corporate Governance Committee regularly assesses the skills, background and expertise of the members of the Board and identifies the Company’s needs. As part of this process, the Nominating and Corporate Governance Committee strives to select nominees with relevant business experience, the personal characteristics described above and a wide variety of skills and viewpoints, informed by diversity of race, ethnicity and gender. The table below highlights certain experiences, skills and knowledge held by each of our current Directors and Nominees that are relevant to the Company’s business. The table reflects information provided by each of our Directors in their responses to our annual Director’s Questionnaire. The table is a summary and is not intended to be a complete list of each Director’s or Nominee’s skills or contributions to the Board. No one experience, skill or attribute is dispositive in the Board’s decision to nominate or re-nominate an individual to our Board of Directors.

| Page 16 |

2024 Proxy Statement |

|

Proposal 1 — Election of Directors

DIRECTORS’ SKILLS MATRIX

| Skills* |

Aghili | Brlas | Doss | Hagemann | Martens | Rhinehart | Scarborough | Venturelli | Wentworth | |||||||||

| Senior Executive Leadership Experience (experience as a CEO, CFO or other |

X | X | X | X | X | X | X | X | X | |||||||||

| Operations Experience (experience leading teams performing complex manufacturing, logistics and supply chain activities) |

X | X | X | X | X | X | X | X | ||||||||||

| International Business Experience (experience managing operations and personnel and addressing customers and markets outside of the U.S.) |

X | X | X | X | X | X | X | X | ||||||||||

| Mergers and Acquisitions Experience (experience assessing potential acquisitions and structuring, negotiating and integrating significant acquisitions) |

X | X | X | X | X | X | X | X | X | |||||||||

| Innovation Management Experience (experience in the areas of research and development and marketing and promotion of new products in varied markets) |

X | X | X | X | X | X | X | |||||||||||

| Cybersecurity Risk Management and IT Expertise (experience providing meaningful understanding of information technology systems and the mitigation of cybersecurity risks) |

X | X | X | X | X | |||||||||||||

| Human Capital Management Experience (experience with programs to identify, attract, compensate, retain and develop diverse talent, to create a high- |

X | X | X | X | X | X | X | X | X | |||||||||

| Environmental, Social and Governance (experience with the development and oversight of an effective corporate responsibility strategy, including disclosures and mitigation of both legal and reputational |

X | X | X | X | X | X | X | X | ||||||||||

| Sustainability and Climate Risk Management Experience (experience with the implementation and oversight of an effective sustainability program, including climate risk management, and related disclosures to regulators and the public) |

X | X | X | X | X | |||||||||||||

| Years of Other Public Company Board Service (the aggregate number of years of public company board service, excluding service on Graphic Packaging Holding Company’s Board of Directors) |

4 | 30 | 3 | 23 | 18 | 17 | 31 | 0 | 23 |

| * | Generally, the skill or expertise is in addition to experience on the Company’s Board of Directors. |

|

|

2024 Proxy Statement | Page 17 |

Proposal 1 — Election of Directors

The Nominating and Corporate Governance Committee also recognizes the importance of selecting directors from a range of backgrounds and professions to provide the Board a wealth of experiences and perspectives to inform its decisions and enhance its cognitive diversity. Consistent with this philosophy, the Nominating and Corporate Governance Committee evaluates the ability of a potential director to contribute to the Board by leveraging a broad range of experiences, as well as the potential director’s ethnic, gender, generational and racial diversity. Currently, the Board has three female directors and one ethnically diverse director.

The Nominating and Corporate Governance Committee considers candidates recommended by its members and other Directors, as well as those identified by a third-party search firm retained to assist in identifying candidates. The Nominating and Corporate Governance Committee will also consider whether to nominate any person recommended by a stockholder pursuant to the provisions of the Company’s By-Laws relating to stockholder nominations as described in “Stockholder Proposals and Nominations” below. The Nominating and Corporate Governance Committee uses the same criteria to evaluate proposed nominees that are recommended by Directors or a search firm as it does for stockholder-recommended nominees.

BOARD RECOMMENDATION

The Board believes that voting for each of the three nominees for Director selected by the Board is in the best interests of the Company and its stockholders. The Board recommends a vote “FOR” each of the three nominees for Director.

COMPENSATION OF DIRECTORS

Annually, WTW benchmarks the amount and type of compensation paid to the Company’s non-employee Directors against that paid by other companies in the Industry Specific Peer Group used for comparing executive officer compensation (as described in “Compensation Discussion and Analysis—Peer Group and Market Data”), as well as against a large published survey of non-employee director compensation across a wide range of industries and company sizes. The goal is to set non-management Director compensation at roughly the mid-point of compensation paid by companies of similar size in similar industries. The Nominating and Corporate Governance Committee reviews the benchmarking materials and approves and recommends all non-management Director compensation changes for approval by the full Board of Directors.

The following table sets forth information regarding the compensation of the non-employee Directors of the Company who served in 2023.

Director Compensation

| Name |

Fees Earned or Paid in Cash ($)(1) |

Stock Awards ($)(1) |

Total ($) |

|||||||||

| Aziz Aghili |

115,938 | 160,000 | 275,938 | |||||||||

| Laurie Brlas |

115,938 | 160,000 | 275,938 | |||||||||

| Paul D. Carrico(2) |

27,500 | 0 | 27,500 | |||||||||

| Robert A. Hagemann |

115,938 | 160,000 | 275,938 | |||||||||

| Philip R. Martens |

265,938 | 160,000 | 425,938 | |||||||||

| Mary K. Rhinehart |

115,938 | 160,000 | 275,938 | |||||||||

| Dean A. Scarborough |

115,938 | 160,000 | 275,938 | |||||||||

| Larry M. Venturelli |

140,938 | 160,000 | 300,938 | |||||||||

| Lynn A. Wentworth |

135,938 | 160,000 | 295,938 | |||||||||