UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

|

þ

|

|

Preliminary Proxy Statement |

|

o

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

o

|

|

Definitive Proxy Statement |

|

o

|

|

Definitive Additional Materials |

|

o

|

|

Soliciting Material Pursuant to §240.14a-12 |

Graphic Packaging Holding Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

þ

|

|

No fee required. |

|

o

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

(1) |

|

Title of each class of securities to which transaction applies: |

| |

| |

|

|

|

| |

|

|

|

| |

| |

(2) |

|

Aggregate number of securities to which transaction applies: |

| |

| |

|

|

|

| |

|

|

|

| |

| |

(3) |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act

Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was

determined): |

| |

| |

|

|

|

| |

|

|

|

| |

| |

(4) |

|

Proposed maximum aggregate value of transaction: |

| |

| |

|

|

|

| |

|

|

|

| |

| |

(5) |

|

Total fee paid: |

| |

| |

|

|

|

| |

|

|

|

|

o

|

|

Fee paid previously with preliminary materials. |

| |

|

o

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2)

and identify the filing for which the offsetting fee was paid previously. Identify the

previous filing by registration statement number, or the Form or Schedule and the date of its

filing. |

| |

(1) |

|

Amount Previously Paid: |

| |

| |

|

|

|

| |

|

|

|

| |

| |

(2) |

|

Form, Schedule or Registration Statement No.: |

| |

| |

|

|

|

| |

|

|

|

| |

| |

(3) |

|

Filing Party: |

| |

| |

|

|

|

| |

|

|

|

| |

| |

(4) |

|

Date Filed: |

| |

| |

|

|

|

| |

|

|

|

March 31,

2009

Dear Graphic Packaging Holding Company Stockholders:

It is my pleasure to invite you to Graphic Packaging Holding

Companys 2009 Annual Meeting of Stockholders, to be held

at the Renaissance Waverly Hotel, 2450 Galleria Parkway,

Atlanta, Georgia 30339, on Wednesday, May 13, 2009, at

10:00 a.m. local time.

The formal Notice of Annual Meeting and Proxy Statement are

enclosed with this letter. The Proxy Statement describes the

matters to be acted upon at the Annual Meeting. It also

describes how our Board of Directors operates and provides

compensation and other information about the management and

Board of Directors of Graphic Packaging Holding Company.

Whether or not you plan to attend the Annual Meeting, your vote

is important and I hope you will vote as soon as possible. You

may vote over the Internet, by telephone or by mailing a proxy

or voting instruction card. Voting over the Internet, by

telephone or by written proxy will ensure your representation at

the Annual Meeting, regardless of whether you attend in person.

If you hold your shares in your own name and choose to attend

the Annual Meeting, you may revoke your proxy and personally

cast your votes at the Annual Meeting. If you hold your shares

through an account with a brokerage firm, bank or other nominee,

please follow instructions from such firm to vote your shares.

Sincerely yours,

John R. Miller

Chairman of the Board

Notice

of

Annual Meeting of Stockholders

of

Graphic Packaging Holding Company

| |

|

|

|

Date:

|

|

May 13, 2009

|

|

Time:

|

|

10:00 a.m. local time

|

|

Place:

|

|

Renaissance Waverly Hotel

2450 Galleria Parkway

Atlanta, Georgia 30339

|

Purposes:

|

|

|

| |

|

To elect three Class II Directors to serve a three-year

term and until the 2012 Annual Meeting of Stockholders;

|

| |

| |

|

To approve an amendment to the Graphic Packaging Corporation

2004 Stock and Incentive Plan (i) to increase the number of

shares of Graphic Packaging Holding Companys common stock

that may be granted pursuant to awards by

12,000,000 shares; (ii) to reapprove and add to a list

of qualified business criteria for performance-based awards; and

(iii) to make other conforming changes;

|

| |

| |

|

To approve an amendment to the Restated Certificate of

Incorporation of Graphic Packaging Holding Company that would

permit its Board of Directors to implement, at their discretion,

a reverse stock split of the common stock at any time prior to

the 2010 Annual Meeting of Stockholders; and

|

| |

| |

|

To transact any other business that may be properly brought

before the Annual Meeting.

|

Only stockholders of record at the close of business on

March 16, 2009 are entitled to notice of and to vote at the

Annual Meeting of Stockholders and at any adjournment thereof.

By order of the Board of Directors,

Stephen A. Hellrung

Senior Vice President, General Counsel

and Secretary

814 Livingston Court

Marietta, Georgia 30067

March 31, 2009

YOUR VOTE IS VERY IMPORTANT.

EVEN IF YOU PLAN TO ATTEND THE ANNUAL MEETING OF STOCKHOLDERS

IN PERSON, PLEASE AUTHORIZE YOUR PROXY OR DIRECT YOUR VOTE BY

INTERNET OR TELEPHONE, AS DESCRIBED IN THE ENCLOSED PROXY

STATEMENT, OR COMPLETE, SIGN AND DATE THE ENCLOSED PROXY CARD

AND RETURN IT PROMPTLY BY MAIL IN THE ENVELOPE PROVIDED. IF YOU

MAIL THE PROXY CARD, NO POSTAGE IS REQUIRED IF MAILED IN THE

UNITED STATES.

TABLE OF

CONTENTS

| |

|

|

|

|

|

|

|

|

1

|

|

|

|

|

|

3

|

|

|

|

|

|

3

|

|

|

|

|

|

8

|

|

|

|

|

|

12

|

|

|

|

|

|

12

|

|

|

|

|

|

18

|

|

|

|

|

|

23

|

|

|

|

|

|

25

|

|

|

|

|

|

33

|

|

|

|

|

|

33

|

|

|

|

|

|

43

|

|

|

|

|

|

48

|

|

|

|

|

|

50

|

|

|

|

|

|

50

|

|

|

|

|

|

51

|

|

|

|

|

|

52

|

|

|

|

|

|

54

|

|

Proxy

Statement

for the

Annual Meeting of Stockholders

on

May 13, 2009

GENERAL

INFORMATION

This Proxy Statement is being furnished in connection with the

solicitation by the Board of Directors (the Board of

Directors or Board) of Graphic Packaging

Holding Company, a Delaware corporation (the

Company), of proxies to be voted at the 2009 Annual

Meeting of Stockholders to be held at the Renaissance Waverly

Hotel, located at 2450 Galleria Parkway, Atlanta, Georgia 30339,

on Wednesday, May 13, 2009, at 10:00 a.m. local time

(the Annual Meeting). This Proxy Statement and the

enclosed proxy card will first be sent on or before

April 3, 2009 to the Companys stockholders of record

as of the close of business on March 16, 2009 (the

Record Date). References in this Proxy Statement to

Graphic Packaging, GPHC we,

us, and our or similar terms are to

Graphic Packaging Holding Company.

Outstanding

Shares

As of the close of business on the Record Date, there were

342,568,704 shares of the Companys common stock

outstanding and entitled to vote. Stockholders are entitled to

one vote for each share held on all matters to come before the

Annual Meeting.

Who May

Vote

Only stockholders who held shares of the Companys common

stock at the close of business on the Record Date are entitled

to notice of and to vote at the Annual Meeting or any

adjournment thereof.

How to

Vote in Person

If your shares are registered directly in your name, you are

considered a stockholder of record and you may vote in person at

the Annual Meeting. If your shares are registered through a bank

or brokerage firm, your shares are considered to be held

beneficially in street name. If your shares are held

beneficially in street name and you wish to vote in person at

the Annual Meeting, you will need to obtain a proxy from the

bank or brokerage firm that holds your shares. Please note that

even if you plan to attend the Annual Meeting in person, the

Company recommends that you vote before the Annual Meeting.

How to

Vote by Proxy

Whether you hold shares directly as a stockholder of record or

beneficially in street name, you may direct how your shares are

voted without attending the Annual Meeting. If you are a

stockholder of record, you may vote by any of the methods

described below. If you hold shares beneficially in street name,

you may vote by submitting voting instructions to your broker,

trustee or nominee. For directions on how to vote, please refer

to the instructions below and those included on your proxy card

or, for shares held beneficially in street name, the voting

instruction card provided by your bank or brokerage firm.

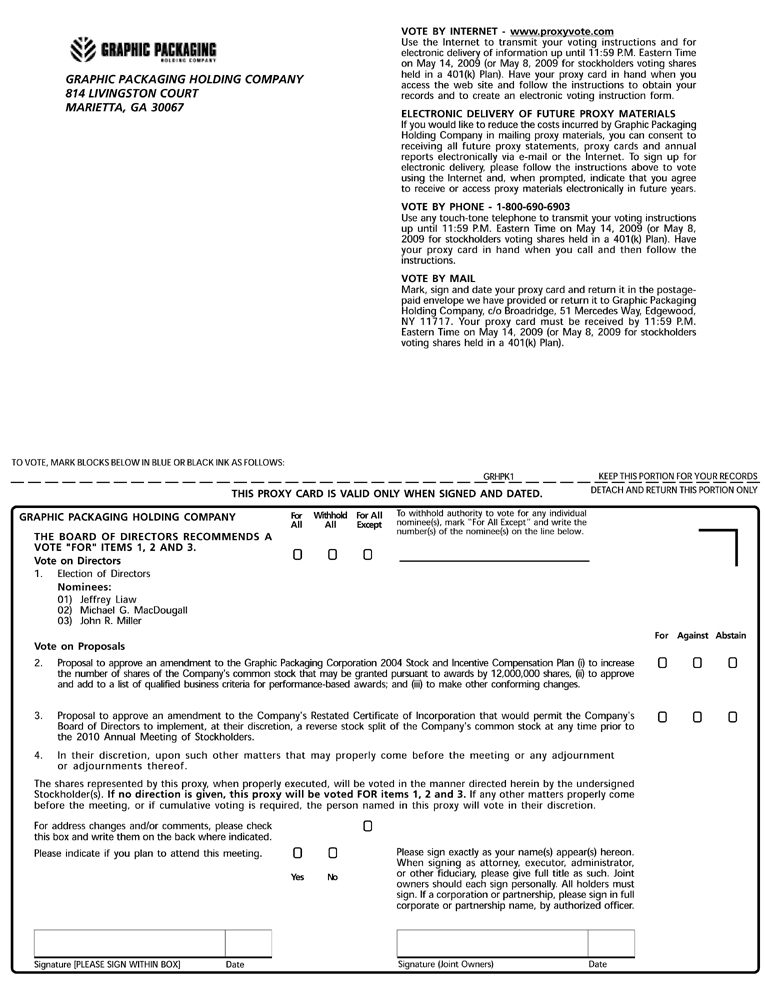

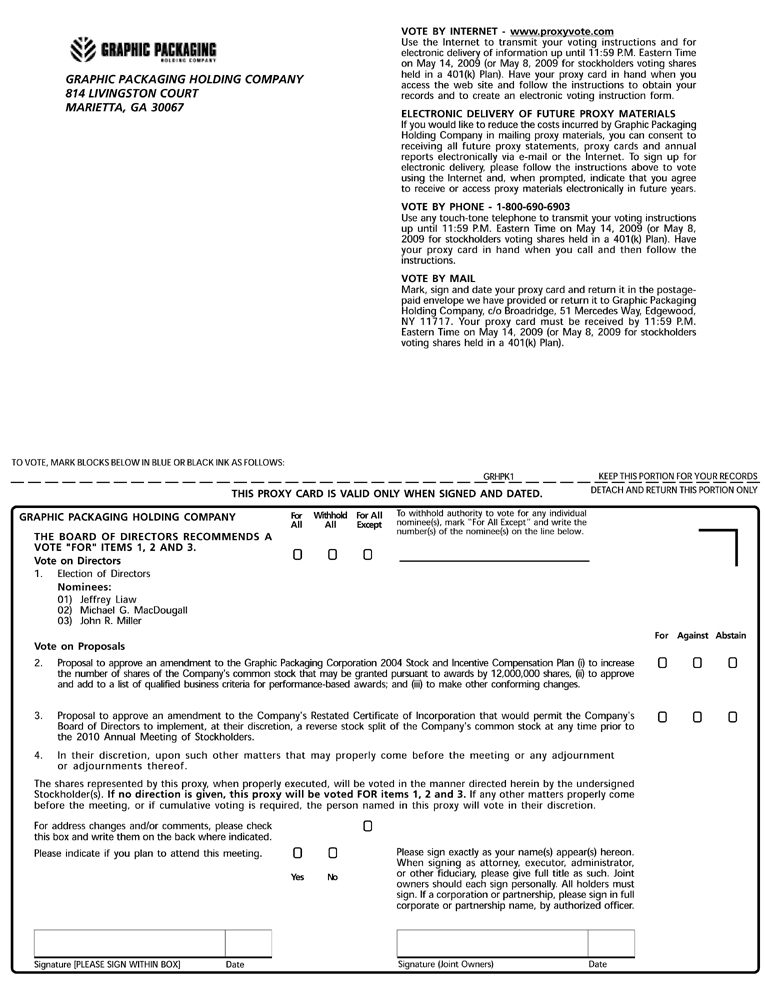

Voting over the Internet. Stockholders of

record of the Companys common stock with Internet access

may submit proxies from any location in the world by following

the Vote by Internet instructions on their

proxy cards. In addition, most of the Companys

stockholders who hold shares beneficially in street name may

vote by accessing the website specified on the voting

instruction card provided by their bank or brokerage firm.

Please check the voting instruction card to determine Internet

voting availability.

Voting by Telephone. Stockholders of record of

the Companys common stock who live in the

United States or Canada may submit proxies by following the

Vote by Phone instructions on their proxy cards.

Most of the Companys stockholders who hold shares

beneficially in street name may vote by phone by calling the

number specified on the voting instruction card provided by

their bank or brokerage firm. Please check the voting

instruction card to determine telephone voting availability.

Voting by Mail. Stockholders of record of the

Companys common stock may submit proxies by completing,

signing and dating the enclosed proxy card and mailing it in the

accompanying pre-addressed envelope. The Companys

stockholders who hold shares beneficially in street name may

vote by mail by completing, signing and dating the voting

instruction card provided by their bank or brokerage firm and

mailing them in the accompanying pre-addressed envelope.

How

Proxies Work

The Board of Directors is asking for your proxy. By giving the

Board your proxy, your shares will be voted at the Annual

Meeting in the manner you direct. If you do not specify how you

wish to vote your shares, your shares will be voted

FOR the election of each of the Director nominees,

FOR the amendment of the Graphic Packaging

Corporation 2004 Stock and Incentive Plan (the 2004

Plan), and FOR the amendment of the

Companys Restated Certificate of Incorporation that would

permit the Companys Board of Directors to implement a

reverse stock split of the Companys common stock.

Proxyholders will vote shares according to their discretion on

any other matter properly brought before the Annual Meeting.

If for any reason any of the nominees for election as Director

is unable or declines to serve as a Director, discretionary

authority may be exercised by the proxyholders to vote for a

substitute proposed by the Board.

If the shares you own are held beneficially in street name by a

bank or brokerage firm, such firm, as the record holder of your

shares, is required to vote your shares according to your

instructions. In order to vote your shares, you will need to

follow the directions your bank or brokerage firm provides to

you. Under the rules of the New York Stock Exchange (the

NYSE), if you do not give instructions to your bank

or brokerage firm, it will still be able to vote your shares

with respect to certain discretionary items, but

will not be allowed to vote your shares with respect to certain

non-discretionary items. In the case of

non-discretionary items, the shares will be treated as

broker non-votes.

How to

Vote Your 401(k) Plan Shares

If you participate in the Companys 401(k) Savings Plan or

in the Companys Hourly 401(k) Savings Plan (the

401(k) Plans), you may give voting instructions as

to the number of shares of the Companys common stock held

in your account as of the Record Date to the trustee of the

savings plan. You provide voting instructions to the trustee,

Fidelity Management Trust Company, by completing and

returning the proxy card accompanying this Proxy Statement. The

trustee will vote your shares in accordance with your duly

executed instructions received by 12:00 midnight on May 8,

2009. If you do not send instructions, the trustee will vote the

number of shares equal to the share equivalents credited to your

account in the same proportion that it votes shares for which it

did receive timely instructions.

You may also revoke voting instructions previously given to the

trustee by 12:00 midnight on May 8, 2009, by filing either

a written notice of revocation or a properly completed and

signed proxy card bearing a later date with the trustee. Your

voting instructions will be kept confidential by the trustee.

Quorum

In order to carry out the business of the Annual Meeting, there

must be a quorum. This means that at least a majority of the

outstanding shares eligible to vote must be represented at the

Annual Meeting, either by proxy or in person. Proxies received

but marked as abstentions and broker non-votes will be included

in the

2

calculation of the number of votes present at the Annual Meeting

for purposes of calculating whether a quorum is present.

Votes

Needed

The Director nominees receiving the largest number of votes cast

are elected, up to the maximum number of Directors fixed by the

Board to be elected at the Annual Meeting. As a result, any

shares not voted, whether by abstention, broker non-vote or

otherwise, have no effect on the election of Directors, except

to the extent that the failure to vote for a particular nominee

may result in another nominee receiving a larger number of

votes. Approval of the amendment to the Companys Restated

Certificate of Incorporation requires the affirmative vote of

holders of a majority of shares outstanding and entitled to

vote. Approval of any other matter properly brought before the

Annual Meeting requires the affirmative vote of holders of a

majority of the shares present in person or by proxy and

entitled to vote at the Annual Meeting. An abstention with

respect to the amendment of the Restated Certificate of

Incorporation or any other matter will have the effect of a vote

against such proposal and broker non-votes will have no effect,

as broker non-votes are not treated as shares entitled to vote.

Changing

Your Vote

Shares of the Companys common stock represented by proxy

will be voted as directed unless the proxy is revoked. Any proxy

may be revoked before it is exercised by sending an instrument

revoking the proxy or a proxy bearing a later date to the

Companys Corporate Secretary. Any notice of revocation

should be sent to: Graphic Packaging Holding Company, 814

Livingston Court, Marietta, Georgia 30067, Attention: Corporate

Secretary. Any proxy submitted over the Internet or by telephone

may also be revoked by submitting a new proxy over the Internet

or by telephone. A proxy is also revoked if the person who

executed the proxy is present at the Annual Meeting and elects

to vote in person.

Attending

in Person

Only stockholders, their designated proxies and guests of the

Company may attend the Annual Meeting. If your shares are held

beneficially in street name, you must bring an account statement

or letter from your brokerage firm or bank showing that you are

the beneficial owner of shares of the Companys common

stock as of the Record Date in order to be admitted to the

Annual Meeting.

Internet

Availability of this Proxy Statement and

Form 10-K

The Companys Proxy Statement, 2008 Annual Report to

Stockholders and 2008 Annual Report on

Form 10-K

are available on the Companys website at

www.graphicpkg.com.

SUMMARY

OF COMBINATION WITH ALTIVITY PACKAGING, LLC

On March 10, 2008, the businesses of Graphic Packaging

Corporation (GPC) and Altivity Packaging, LLC

(Altivity) were combined through a series of

transactions. A new publicly-traded parent company, Graphic

Packaging Holding Company, was formed and all of the equity

interests in Altivitys parent company were contributed to

GPHC in exchange for 139,445,038 shares of its common

stock. Stockholders of GPC received one share of GPHC common

stock for each share of GPC common stock held immediately prior

to the transactions. Subsequently, all of the equity interests

in Altivitys parent company were contributed to

GPHCs primary operating company, Graphic Packaging

International, Inc. Together, these transactions are referred to

herein as the Altivity Transaction.

CORPORATE

GOVERNANCE MATTERS

Below, in question and answer format, is a summary of certain of

the Companys corporate governance policies and practices.

3

Who are

Graphic Packagings Directors?

The Board currently consists of George V. Bayly, John D.

Beckett, G. Andrea Botta, Kevin J. Conway, Jeffrey H. Coors,

Kelvin L. Davis, Matthew J. Espe, Jeffrey Liaw, Harold R.

Logan, Jr., Michael G. MacDougall, John R. Miller (who

serves as the Chairman of the Board), David W. Scheible (who

serves as President and Chief Executive Officer of the Company)

and Robert W. Tieken. The members of the GPC Board from

January 1, 2008 through the closing of the Altivity

Transaction were Messrs. Beckett, Botta, Conway, Coors,

Logan, Miller, Scheible and Tieken, as well as William R.

Fields. In addition, Mr. Jack A. Fusco served as a member

of the Board of Directors from March 10, 2008 through

August 13, 2008. Mr. Espe was elected to the Board on

March 4, 2009 to fill the vacancy created when

Mr. Fusco resigned.

How does

Graphic Packaging determine which Directors are

independent?

For purposes of this Proxy Statement, independent

and independence have the meanings set forth under

the Securities Exchange Act of 1934 (the Exchange

Act), as amended, the rules and regulations adopted

thereunder by the Securities and Exchange Commission (the

SEC), the corporate governance listing standards of

the NYSE, and the Companys Corporate Governance

Guidelines, all as in effect from time to time. A Director will

not qualify as independent unless the Board affirmatively

determines that the Director has no material relationship with

the Company (either directly or as a partner, stockholder or

officer of an organization that has a relationship with the

Company). In addition, in accordance with the Companys

Corporate Governance Guidelines, the Company will also apply the

following standards in determining whether a Director is

independent:

|

|

|

| |

|

A Director who is an employee of the Company, or whose immediate

family member serves as one of the Companys executive

officers, may not be deemed independent until three years after

the end of such employment relationship.

|

| |

| |

|

A Director who receives, or whose immediate family member

receives, more than $100,000 per year in direct compensation

from the Company, other than Board and committee fees and

pension or other forms of deferred compensation for prior

service, may not be deemed independent until three years after

he or she ceases to receive more than $100,000 per year in such

compensation. Compensation received by an immediate family

member for service as one of the Companys non-executive

employees will not be considered in determining independence

under this test.

|

| |

| |

|

A Director who is affiliated with or employed by, or whose

immediate family member is affiliated with or employed in a

professional capacity by, the Companys present or former

internal or external auditor may not be deemed independent until

three years after the end of the affiliation or the employment

or auditing relationship.

|

| |

| |

|

A Director who is employed, or whose immediate family member is

employed, as an executive officer of another company where any

of the Companys current executive officers serve on that

companys compensation committee may not be deemed

independent until three years after the end of such service or

the employment relationship.

|

| |

| |

|

A Director who is an executive officer, general partner or

employee, or whose immediate family member is an executive

officer or general partner, of an entity that makes payments to,

or receives payments from the Company for property or services

in an amount which, in any single fiscal year, exceeds the

greater of $1 million or 2% of such other entitys

consolidated gross revenues, may not be deemed independent until

three years after falling below that threshold.

|

Applying these standards, the following seven of the

Companys thirteen Directors are independent:

Messrs. Bayly, Beckett, Botta, Espe, Logan, Miller and

Tieken. Mr. Scheible is not considered independent because

he serves as an executive officer of the Company. Mr. Coors

is not considered independent because he is a former executive

officer of Graphic Packaging Corporation and is the Coors family

representative under the Stockholders Agreement dated

July 9, 2007 (the Stockholders Agreement) by

and among the Company, the Coors family trusts and foundation,

Clayton, Dubilier & Rice Fund V Limited

Partnership (the CD&R Fund), Old Town, S.A.

(formerly known as EXOR Group, S.A. and referred to herein as

Old Town), Field

4

Holdings, Inc. and certain affiliates of TPG Capital, L.P. (the

TPG Entities). The Coors family trusts and

foundation own over 18% of the Companys common stock.

Mr. Conway is not considered independent because of his

status as a principal of Clayton, Dubilier & Rice,

Inc. (CD&R), a private investment firm that

manages the CD&R Fund, the holder of approximately 10% of

the Companys common stock and a party to the Stockholders

Agreement. Messrs. Davis, Liaw and MacDougall are not

considered independent because of their status as partners and

employees of TPG Capital, L.P. The TPG Entities own

approximately 38.6% of the Companys common stock and are

parties to the Stockholders Agreement.

The Company is a controlled company, as that term is

defined in the NYSEs corporate governance listing

standards, because more than 50% of the Companys voting

power is held by a group of stockholders consisting of the Coors

family trusts and foundation, the CD&R Fund, Old Town and

the TPG Entities. Please see Certain Relationships and

Related Transactions below. As a controlled

company, the Company is exempt from the requirements of

Rule 303A of the NYSE Listed Company Manual with respect to

having the Board be comprised of a majority of independent

Directors and having the Compensation and Benefits Committee and

Nominating and Corporate Governance Committee being composed

solely of independent Directors.

How many

times did the Board of Directors meet last year?

The Board of Directors of GPC met three times in 2008 and the

Board of Directors of GPHC met five times in 2008.

Did any

of GPCs or GPHCs Directors attend fewer than 75% of

the meetings of the Board and their assigned

committees?

All of the Directors of GPC and GPHC attended at least 75% of

the meetings of the Board and their assigned committees during

2008.

What is

GPHCs policy on Director attendance at annual meetings of

stockholders?

Directors are expected to attend each annual meeting of

stockholders, but are not required to do so. All of GPHCs

Directors, except Messrs. Davis and Logan, attended the

2008 annual meeting of stockholders.

Do the

non-management Directors meet during the year in executive

session?

Yes, the non-management Directors of GPHC met separately at

regularly scheduled executive sessions during 2008 without any

member of management being present. Mr. Miller, as the

Chairman of the Board and Chairman of the Nominating and

Corporate Governance Committee, acted as presiding Director at

each executive session held by GPHC during 2008.

Can

stockholders and other interested parties communicate directly

with the Directors of Graphic Packaging or with the

non-management Directors of Graphic Packaging?

Yes. If you wish to communicate with the Board or any individual

Director, you may send correspondence to Graphic Packaging

Holding Company, 814 Livingston Court, Marietta, Georgia 30067,

Attention: Corporate Secretary. The Corporate Secretary will

submit your correspondence to the Board, the appropriate

committee or the appropriate Director, as applicable. You may

also communicate directly with the presiding non-management

Director of the Board or the non-management Directors as a group

by sending correspondence to Graphic Packaging Holding Company,

814 Livingston Court, Marietta, Georgia 30067, Attention:

Presiding Director.

Does

Graphic Packagings Board of Directors have any

separately-designated standing committees?

The Board currently has three separately-designated standing

committees: the Audit Committee, the Compensation and Benefits

Committee and the Nominating and Corporate Governance Committee.

5

What does

the Audit Committee do?

The Audit Committee is responsible for, among other things,

assisting the Board in its oversight of:

|

|

|

| |

|

the integrity of the Companys financial statements;

|

| |

| |

|

compliance with legal and regulatory requirements;

|

| |

| |

|

systems of internal accounting and financial controls;

|

| |

| |

|

the performance of the annual independent audit of the

Companys financial statements;

|

| |

| |

|

the Companys independent auditors qualifications and

independence;

|

| |

| |

|

the performance of the internal audit function; and

|

| |

| |

|

the review and approval or ratification (if appropriate) of

transactions with related parties.

|

The Audit Committee is also responsible for preparing the Report

of the Audit Committee in conformity with the rules of the SEC

to be included in the proxy statement for the annual meeting of

stockholders.

Who are

the members of the Audit Committee?

The members of GPHCs Audit Committee are

Messrs. Logan, Miller and Tieken, with Mr. Tieken

serving as Chairman. Messrs. Logan, Miller and Tieken also

served as members of GPCs Audit Committee in 2008.

How many

meetings did the Audit Committee have last year?

The Audit Committee of GPC held two meetings during 2008, and

the Audit Committee of GPHC held six meetings during 2008.

Does

Graphic Packaging have an Audit Committee Financial

Expert?

Yes. The Board has examined the SECs definition of

audit committee financial expert and has determined

that each of Harold R. Logan, Jr., John R. Miller and

Robert W. Tieken meet these standards and are each

independent directors, as defined by

Section 303A of the NYSEs Listed Company Manual.

Accordingly, each of Messrs. Logan, Miller and Tieken have

been designated by the Board as an audit committee financial

expert.

What does

the Compensation and Benefits Committee do?

The Compensation and Benefits Committee oversees the

compensation and benefits of the Companys management and

employees and is responsible for, among other things:

|

|

|

| |

|

reviewing and making recommendations as to the compensation of

the President and Chief Executive Officer, the other senior

executives of the Company who report to the Chief Executive

Officer and any employee whose annual base salary exceeds

$250,000;

|

| |

| |

|

approving any equity compensation awards to employees who are

officers for purposes of Section 16 of the

Exchange Act; and

|

| |

| |

|

administering the Companys short- and long-term incentive

plans.

|

Who are

the members of the Compensation and Benefits

Committee?

The members of GPHCs Compensation and Benefits Committee

are currently Messrs. Bayly, Botta and Espe, with

Mr. Bayly serving as Chairman. Mr. Fusco served on the

Compensation and Benefits Committee from March 10, 2008

through August 13, 2008. In September 2008, Mr. Botta

was appointed to the Compensation and Benefits Committee.

Mr. Beckett, who is retiring from the Board of Directors as

of the Annual Meeting, resigned from the Compensation and

Benefits Committee on March 4, 2009. At that time,

6

Mr. Espe was appointed to the Compensation and Benefits

Committee. Messrs. Beckett, Botta and Fields served on

GPCs Compensation and Benefits Committee until

March 10, 2008. All of these Directors are

independent directors, as defined by

Section 303A of the NYSEs Listed Company Manual.

How many

meetings did the Compensation and Benefits Committee have last

year?

The Compensation and Benefits Committee of GPC held one meeting

during 2008 and the Compensation and Benefits Committee of GPHC

held six meetings during 2008.

What does

the Nominating and Corporate Governance Committee do?

The Nominating and Corporate Governance Committee is responsible

for, among other things, identifying qualified individuals for

nomination to the Board and developing and recommending a set of

corporate governance principles to the Board.

Who are

the members of the Nominating and Corporate Governance

Committee?

The members of GPHCs Nominating and Corporate Governance

Committee are currently Messrs. Botta, Conway, Coors,

Davis, MacDougall and Miller, with Mr. Miller serving as

Chairman and a non-voting member. Messrs. Botta, Conway,

Coors, Fields, Miller and Tieken served on GPCs Nominating

and Corporate Governance Committee until March 10, 2008,

with Mr. Miller serving as Chairman. Messrs. Botta,

Fields, Miller and Tieken are each independent

directors, as defined by Section 303A of the

NYSEs Listed Company Manual. As discussed above,

Messrs. Conway, Coors, Davis and MacDougall are not

independent directors.

How many

meetings did the Nominating and Corporate Governance Committee

hold last year?

The Nominating and Corporate Governance Committee of the Board

of Directors of GPC met once during 2008 and the Nominating and

Corporate Governance Committee of GPHC held seven meetings

during 2008.

Does

Graphic Packaging have Corporate Governance

Guidelines?

Yes, the Board has formally adopted Corporate Governance

Guidelines to assure that it will have the necessary authority

and practices in place to review and evaluate the Companys

business operations as needed and to assure that the Board is

focused on increasing stockholder value. The Corporate

Governance Guidelines set forth the practices the Board will

follow with respect to Board composition and selection, Board

meetings and involvement of senior management, evaluation of the

Chief Executive Officers performance and senior management

succession planning, and Board committees and compensation. You

may find a copy of the Corporate Governance Guidelines on the

Companys website at www.graphicpkg.com in the Investor

Relations section under Corporate Governance.

Does

Graphic Packaging have a code of ethics and conduct, and, if so,

where can I find a copy?

Yes, the Board has formally adopted a Code of Business Conduct

and Ethics, which applies to all of the Companys

employees, officers and directors. A copy of the Code of

Business Conduct and Ethics is available on the Companys

website at www.graphicpkg.com in the Investor Relations section

under Corporate Governance.

Does

Graphic Packaging have a policy governing related-party

transactions, and, if so, where can I find a copy?

Yes, the Board has delegated authority to the Audit Committee to

review and approve related-party transactions. The Audit

Committee has adopted a Policy Regarding Related-Party

Transactions that is available on the Companys website at

www.graphicpkg.com in the Investor Relations section under

Corporate Governance.

7

Have the

Boards standing committees adopted charters and, if so,

where can I find copies?

Yes, the Audit Committee, Compensation and Benefits Committee

and Nominating and Corporate Governance Committee have each

adopted charters, copies of which can be found on the

Companys website at www.graphicpkg.com in the Investor

Relations section under Corporate Governance.

How can I

obtain printed copies of the information described

above?

The Company will provide printed copies of the charters of the

Audit Committee, Compensation and Benefits Committee and

Nominating and Corporate Governance Committee, as well as the

Policy Regarding Related-Party Transactions, the Code of

Business Conduct and Ethics and Corporate Governance Guidelines

to any person without charge upon request.

PROPOSAL 1

ELECTION OF DIRECTORS

The Companys Board of Directors has thirteen members

divided into three classes, with one class being elected each

year for a three-year term. The three nominees standing for

election as Class II Directors are: Jeffrey Liaw, Michael

G. MacDougall and John R. Miller. Mr. John D. Beckett, who

is currently serving as a Class II Director, is retiring

from the Board and, therefore, is not standing for re-election.

If elected, each Class II nominee will serve three

consecutive years with his term expiring in 2012, and until a

successor is elected and qualified. The election of the Director

nominees is by plurality vote, which means that the three

nominees receiving the highest number of affirmative votes will

be elected. If at the time of the Annual Meeting, any of these

nominees is unable or unwilling to serve as a Director for any

reason, which is not expected to occur, the persons named as

proxies will vote for such substitute nominee or nominees, if

any, as shall be designated by the Board. See Certain

Relationships and Related Transactions Stockholders

Agreement for information regarding rights that certain

stockholders have to designate nominees for director and the

obligations of certain stockholders to vote for certain nominees.

Set forth below is certain information furnished to the Company

by the Director nominees and by each of the incumbent Directors

whose term will continue after the Annual Meeting. There are no

family relationships among any Directors or executive officers

of the Company.

Information

Concerning the Nominees

Class II

Directors Term to Expire in 2012

Jeffrey Liaw, 32, was appointed to GPHCs Board on

March 10, 2008. Mr. Liaw has been employed in TPG

Capitals Energy and Industrial investing practice areas

since 2005. Prior to joining TPG Capital in 2005, Mr. Liaw

was an associate at Bain Capital, a private equity investment

firm, in its Industrials practice. Mr. Liaw is a director

and audit committee member of Energy Future Holdings Corp.

(formerly TXU Corp.) and a director and compensation committee

member of Oncor Electric Delivery Company. Mr. Liaw is a

graduate of the University of Texas at Austin and received his

M.B.A. from Harvard Business School where he was a Baker Scholar

and a Siebel Scholar.

Michael G. MacDougall, 38, was appointed to GPHCs

Board on March 10, 2008. Mr. MacDougall is a partner

of TPG Capital. Prior to joining TPG Capital in 2002,

Mr. MacDougall was a vice president in the Principal

Investment Area of the Merchant Banking Division of Goldman,

Sachs & Co., where he focused on private equity and

mezzanine investments. He is a director of Kraton Polymers LLC,

Aleris International, Inc. and Energy Future Holdings Corp.

(formerly TXU Corp.). Mr. MacDougall served on the board of

managers of Texas Genco LLC prior to its sale to NRG Energy,

Inc. in February 2006. He also serves as the Chairman of the

Board of The Opportunity Network and is a member of the Board of

The Dwight School Foundation and Iselsboro Affordable Property.

Mr. MacDougall is a graduate of the University of Texas at

Austin and received his M.B.A. with distinction from Harvard

Business School.

8

John R. Miller, 71, was appointed to GPHCs Board on

March 10, 2008 and serves as its Chairman. Prior to the

Altivity Transaction, Mr. Miller had served as the

non-executive Chairman of the Board of Directors of GPC since

August 8, 2006 and had been a member of such Board since

2002. He has served as Chairman of the Board of Directors of

Cambrex Corporation, a life science company, since 2008 and has

been a member of such Board since 1998. Mr. Miller has been

a director of Eaton Corporation, a global diversified industrial

manufacturer, since 1985. From 2005 to 2008, he served on the

Board of SIRVA, Inc., a global provider of moving and relocation

services, serving as Chairman of the Board from 2006 to 2008. He

formerly served as President and Chief Operating Officer of The

Standard Oil Company and Chairman of the Federal Reserve Bank of

Cleveland.

Information

Concerning Continuing Directors

Class I

Directors Term to Expire in 2011

G. Andrea Botta, 55, was appointed to GPHCs

Board on March 10, 2008. Prior to the Altivity Transaction,

he had served as a member of GPCs Board since 1996.

Mr. Botta has served as the President of Glenco LLC, a

private investment company, since February 2004. From 1999 to

February 2004, Mr. Botta served as a managing director of

Morgan Stanley. Before joining Morgan Stanley, he was President

of EXOR America, Inc. (formerly IFINT-USA, Inc.) from 1993 until

September 1999 and for more than five years prior thereto, Vice

President of Acquisitions of IFINT-USA, Inc.

Kevin J. Conway, 50, was appointed to GPHCs Board

on March 10, 2008. Prior to the Altivity Transaction, he

had served as a member of GPCs Board since 1995.

Mr. Conway is the Managing Partner of CD&R, a New

York-based private investment firm, a director of CD&R

Investment Associates II, Inc. (Associates II), a

Cayman Islands exempted company that is the managing general

partner of CD&R Associates V Limited Partnership, a Cayman

Islands exempted limited partnership (Associates V),

the general partner of CD&R, and a limited partner of

Associates V.

Jeffrey H. Coors, 64, was appointed to GPHCs Board

on March 10, 2008. Prior to the Altivity Transaction, he

had served as a member of GPCs Board since August 2003. He

also served as GPCs Vice Chairman from August 2006 through

his retirement on December 31, 2007, and as Executive

Chairman from August 2003 through August 2006. Mr. Coors

was Chairman of Graphic Packaging International Corporation from

2000 and until August 2003, and was its Chief Executive Officer

and President from Graphic Packaging International

Corporations formation in 1992 until August 2003.

Mr. Coors served as Executive Vice President of the Adolph

Coors Company from 1991 to 1992 and as its President from 1985

to 1989, and as President of Coors Technology Companies from

1989 to 1992. Mr. Coors currently serves as a director of

R.W. Beckett Corporation.

Kelvin L. Davis, 45, was appointed to GPHCs Board

on March 10, 2008. Mr. Davis is a Senior Partner of

TPG Capital and Head of the firms North American Buyouts

Group, incorporating investments in all non-technology industry

sectors. Prior to joining TPG in 2000, Mr. Davis was

President and Chief Operating Officer of Colony Capital, Inc., a

private international real estate-related investment firm in Los

Angeles, which he co-founded in 1991. Prior to the formation of

Colony, Mr. Davis was a principal of RMB Realty, Inc., the

real estate investment vehicle of Robert M. Bass. Prior to his

affiliation with RMB Realty, he worked at Goldman,

Sachs & Co. in New York City and with Trammell Crow

Company in Dallas and Los Angeles. Mr. Davis earned a B.A.

degree (Economics) from Stanford University and a M.B.A. from

Harvard University, where he was a Baker Scholar, a John L. Loeb

Fellow, and a Wolfe Award recipient. Mr. Davis is a

director of Kraton Polymers LLC, Aleris International, Inc.,

Harrahs Entertainment, Inc.,

Metro-Goldwyn-Mayer

Studios Inc. and Univision Communications Inc. He is also a

ten-year Director (and past Chairman) of Los Angeles Team

Mentoring, Inc. (a charitable mentoring organization), is a

director of the Los Angeles Philharmonic Association, and is on

the Board of Overseers and Art Collections Council of the

Huntington Library, Art Collections, and Botanical Gardens.

David W. Scheible, 52, was appointed to GPHCs Board

upon its formation (under the name New Giant Corporation) in

June 2007. Prior to the Altivity Transaction, he had served as a

director, President and Chief Executive Officer of GPC since

January 1, 2007. Prior to that time, Mr. Scheible had

served as Chief

9

Operating Officer of GPC since October 2004. Mr. Scheible

served as Executive Vice President of Commercial Operations from

August 2003 until October 2004. Mr. Scheible served as

Graphic Packaging International Corporations Chief

Operating Officer from 1999 until August 2003. He also served as

President of Graphic Packaging International Corporations

Flexible Division from January to June 1999. Previously,

Mr. Scheible was affiliated with the Avery Dennison

Corporation, working most recently as its Vice President and

General Manager of the Specialty Tape Division from 1995 through

1999 and Vice President and General Manager of the Automotive

Division from 1993 to 1995.

Class III

Directors Term to Expire in 2010

George V. Bayly, 66, was appointed to GPHCs Board

on March 10, 2008. Mr. Bayly served as Chairman and

interim Chief Executive Officer of Altivity from October 2006 to

March 10, 2008. Prior to October 2006, Mr. Bayly

served as Co-Chairman of U.S. Can Corporation from

September 2005 to September 2006, as well as Co-Chairman and

Chief Executive Officer from March 2005 to September 2005. In

addition, Mr. Bayly has been a principal of Whitehall

Investors, LLC, a consulting and venture capital firm, since

January 2002. From January 1991 to December 2002, Mr. Bayly

served as Chairman, President and Chief Executive Officer of

Ivex Packaging Corporation. From 1987 to 1991, Mr. Bayly

served as Chairman, President and Chief Executive Officer of

Olympic Packaging, Inc. Mr. Bayly also held various

management positions with Packaging Corporation of America from

1973 to 1987. Mr. Bayly serves on the Board of Directors of

ACCO Brands Corporation, Huhtamaki Oyj and Treehouse Foods, Inc.

Mr. Bayly holds a B.S. from Miami University and a M.B.A.

from Northwestern University. Mr. Bayly also served as a

Lieutenant Commander in the United States Navy.

Matthew J. Espe, 50, joined GPHCs Board on March 4,

2009. Mr. Espe is the Chairman, President and Chief

Executive Officer of IKON Office Solutions, Inc., a position he

has held since 2003, and served as Chief Executive Officer and

Director since 2002. IKON is a provider of integrated document

management systems and services. Prior to his employment with

IKON, Mr. Espe was President and Chief Executive Officer of

GE Lighting from 2000 through 2002, President of GE

Plastics-Europe from 1999 through 2000, and President of GE

Plastics-Asia from 1998 through 1999, each a division of General

Electric Company, a diversified industrial company. He also

serves on the Advisory Board to the University of Idaho, is a

director of Unisys Corporation and is a member of the United Way

of Southeastern Pennsylvania Board.

Harold R. Logan, Jr., 64, was appointed to

GPHCs Board on March 10, 2008. Prior to the Altivity

Transaction, Mr. Logan had served as a member of GPCs

Board since August 2003. From 2001 until August 2003,

Mr. Logan served as one of the directors of Graphic

Packaging International Corporation. From 2003 through September

2006, Mr. Logan was a director and Chairman of the Finance

Committee of TransMontaigne, Inc., a transporter of refined

petroleum products, and was a director, Executive Vice

President, and Chief Financial Officer of TransMontaigne, Inc.

from 1995 to 2002. TransMontaigne, Inc. was sold to Morgan

Stanley Group, Inc. on October 1, 2006. Mr. Logan

served as a director and Senior Vice President, Finance of

Associated Natural Gas Corporation, a natural gas and crude oil

company, from 1987 to 1994. He also serves as Chairman of the

Board of Supervisors of Suburban Propane Partners, L.P. and as a

director of Hart Energy Publishing, LLC.

Robert W. Tieken, 69, was appointed to GPHCs Board

on March 10, 2008. Prior to the Altivity Transaction,

Mr. Tieken had served as a member of GPCs Board since

September 2003. Mr. Tieken served as the Executive Vice

President and Chief Financial Officer of The Goodyear

Tire & Rubber Company from May 1994 to June 2004.

From 1993 until May 1994, Mr. Tieken served as Vice

President-Finance for Martin Marietta Corporation. From July

2006 until July 2008, Mr. Tieken served as a member of the

Board of Directors of SIRVA, Inc., a global provider of moving

and relocation services, and from August 2007 until

July 2008, as its Chief Executive Officer.

Criteria

for Potential Directors

The Companys Board is responsible for selecting nominees

for election as Directors by stockholders and for filling

vacancies on the Board. The Nominating and Corporate Governance

Committee is responsible for

10

identifying and recommending to the Board individuals for

nomination as members of the Board and its committees and, in

this regard, reviewing with the Board on an annual basis the

current skills, background and expertise of the members of the

Board, as well as the Companys future and ongoing needs.

This assessment is used to establish criteria for identifying

and evaluating potential candidates for the Board. However, as a

general matter, the Nominating and Corporate Governance

Committee seeks individuals who demonstrate:

|

|

|

| |

|

the highest personal and professional integrity;

|

| |

| |

|

commitment to driving the Companys success;

|

| |

| |

|

an ability to provide informed and thoughtful counsel on a range

of issues; and

|

| |

| |

|

exceptional ability and judgment.

|

The Nominating and Corporate Governance Committee considers

candidates recommended by its members and other Directors. The

Nominating and Corporate Governance Committee will also consider

whether to nominate any person recommended by a stockholder

pursuant to the provisions of the Companys By-Laws

relating to stockholder nominations as described in

Stockholder Proposals and Nominations, below. The

Nominating and Corporate Governance Committee uses the same

criteria to evaluate proposed nominees that are recommended by

its members and other Directors as it does for

stockholder-recommended nominees.

Compensation

of Directors

The following table sets forth information regarding the

compensation of the non-employee Directors of GPC and GPHC in

2008.

Director

Compensation Table for 2008

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fees

|

|

|

|

|

|

|

|

|

|

|

Earned

|

|

|

|

|

|

|

|

|

|

|

or Paid

|

|

|

Stock

|

|

|

|

|

|

|

|

in Cash

|

|

|

Awards

|

|

|

Total

|

|

|

Name

|

|

($)

|

|

|

($)(1)

|

|

|

($)

|

|

|

|

|

George V. Bayly

|

|

|

49,853

|

|

|

|

90,000

|

|

|

|

139,853

|

|

|

John D. Beckett

|

|

|

51,277

|

|

|

|

90,000

|

|

|

|

141,277

|

|

|

G. Andrea

Botta(2)

|

|

|

56,779

|

|

|

|

90,000

|

|

|

|

146,779

|

|

|

Kevin J. Conway

|

|

|

51,277

|

|

|

|

90,000

|

|

|

|

141,277

|

|

|

Jeffrey H. Coors

|

|

|

53,777

|

|

|

|

90,000

|

|

|

|

143,777

|

|

|

Kelvin L. Davis

|

|

|

41,000

|

|

|

|

90,000

|

|

|

|

131,000

|

|

|

William R. Fields

|

|

|

11,362

|

|

|

|

0.00

|

|

|

|

11,362

|

|

|

Jack A. Fusco

|

|

|

17,434

|

|

|

|

90,000

|

|

|

|

107,434

|

|

|

Jeffrey Liaw

|

|

|

37,500

|

|

|

|

90,000

|

|

|

|

127,500

|

|

|

Harold R. Logan, Jr.

|

|

|

52,277

|

|

|

|

90,000

|

|

|

|

142,277

|

|

|

Michael G. MacDougall

|

|

|

44,500

|

|

|

|

90,000

|

|

|

|

134,500

|

|

|

John R. Miller

|

|

|

170,573

|

|

|

|

90,000

|

|

|

|

260,573

|

|

|

Robert W. Tieken

|

|

|

65,696

|

|

|

|

90,000

|

|

|

|

155,696

|

|

|

|

|

|

(1)

|

|

The dollar value of stock awards set forth in this column is

equal to the compensation cost recognized during 2008 for

financial statement purposes in accordance with FAS 123R. |

| |

|

(2)

|

|

Mr. Botta previously elected to defer all of the cash and

stock compensation payable to him in 2008. Instead of receiving

cash and stock compensation, he receives phantom stock awards.

In 2008, Mr. Botta received 69,863 shares of phantom

stock. |

Each Director who is not an officer or employee of the Company

receives an annual cash retainer fee of $50,000, payable in

quarterly installments. In addition, each non-employee Director

receives $1,500 per Board meeting attended and $1,000 per

committee meeting attended. The Chairman of the Board, the Audit

Committee Chairman and each of the other Committee Chairmen

receive a further retainer fee of $100,000,

11

$12,000 and $10,000, respectively, payable in equal quarterly

installments. In addition to the retainers and meeting fees,

each non-employee Director receives an annual grant of shares of

common stock with a value of $90,000 on the date of grant.

Non-employee Directors have the option to defer all or part of

the cash and equity compensation payable to them in the form of

phantom stock.

Directors who are officers or employees do not receive any

additional compensation for serving as a Director. Pursuant to

the terms of Mr. Conways employment with CD&R,

he has assigned his right to receive compensation for his

service as a Director to CD&R. The Company reimburses all

Directors for reasonable and necessary expenses they incur in

performing their duties as Directors.

Board

Recommendation

The Board believes that voting for each of the three nominees

for Director selected by the Board is in the best interests of

the Company and its stockholders. The Board recommends a vote

FOR each of the three nominees for Director.

COMPENSATION

AND BENEFITS COMMITTEE REPORT

The members of GPHCs Compensation and Benefits Committee

(prior to the changes in membership as of March 4, 2009

discussed above) reviewed and discussed the following

Compensation Discussion and Analysis with management of the

Company. Based on such review and discussion, the Committee

recommended to the Board of Directors that the Compensation

Discussion and Analysis be included in this Proxy Statement and

incorporated by reference into the Companys Annual Report

on

Form 10-K

for the year ended December 31, 2008.

Compensation and Benefits Committee

George V. Bayly, Chairman

John D. Beckett

G. Andrea Botta

COMPENSATION

DISCUSSION AND ANALYSIS

References to the Committee in this Compensation

Discussion and Analysis section are to the Compensation and

Benefits Committee. References to Executives are to

the Named Executive Officers reported in the Summary

Compensation Table and other tables in this proxy statement.

Guiding

Principles and Policies

The goal of our compensation program is to align the interests

of our employees with those of our stockholders. We do this by

implementing compensation practices designed to attract, retain

and motivate key members of management. A significant portion of

the compensation packages of our Executives is intended to be

at-risk pay for performance. In our program, we analyze each

component of executive compensation and decisions with respect

to one element of pay may or may not impact other elements of

the overall pay packages. Market data, individual performance,

retention needs and internal equity among our Executives

compensation packages have been the primary factors considered

in decisions to increase or decrease compensation materially.

Peer

Group and Market Data

We obtain an analysis of market data at least every other year.

Compensation of the Executives is compared to the compensation

paid to executives holding comparable positions at similar

companies. The companies used for this comparison are chosen by

the Company and the Committees consultant, Hewitt

Associates, and consist of a group of about 30 manufacturing

companies with revenues approximately one-half to double the

revenues of the Company that participate in Hewitt

Associates database of executive pay. This peer group was

originally chosen in 2003 but was revised and reconfirmed based

on the Companys size as a

12

result of the Altivity Transaction. Hewitt Associates tests the

peer group results against data from broader general industry,

manufacturing and forest products groups to ensure that the peer

group provides an appropriate benchmark of executive

compensation.

The peer group used to develop 2008 compensation is listed below.

| |

|

|

|

|

|

Air Products and Chemicals, Inc.

|

|

Ecolab Inc.

|

|

Pactiv Corporation

|

|

Armstrong World Industries, Inc.

|

|

Energizer Holdings, Inc.

|

|

Rockwell Automation, Inc.

|

|

Avery Dennison Corporation

|

|

FMC Technologies, Inc.

|

|

Sonoco Products Company

|

|

C. R. Bard, Inc.

|

|

Herman Miller, Inc.

|

|

Steelcase, Inc.

|

|

Ball Corporation

|

|

ITT Corporation

|

|

The Scotts Miracle-Gro Company

|

|

BorgWarner Inc.

|

|

Kennametal, Inc.

|

|

Thomas & Betts Corporation

|

|

Cameron International Corporation

|

|

MeadWestvaco Corporation

|

|

Tupperware Brands Corporation

|

|

Cooper Industries, Ltd.

|

|

Molson Coors Brewing Company

|

|

UST Inc.

|

|

Dover Corporation

|

|

PACCAR Inc.

|

|

Wm. Wrigley Jr. Company

|

|

Eastman Chemical Company

|

|

Packaging Corporation of America

|

|

|

Role of

Compensation Consultants

The Committee independently retains Hewitt Associates to assist

the Committee in its deliberations regarding executive

compensation. Hewitt Associates is also retained by the Company

to assist with various compensation and benefit matters. The

mandate of Hewitt Associates is to serve the Company and work

for the Committee in its review of executive compensation

practices, including the competitiveness of pay levels, design

issues, market trends and technical considerations. Hewitt

Associates consultants attended five of seven Committee meetings

in 2008, and assisted the Committee with market data and a

related assessment of the Companys executive compensation

levels and long-term incentive design.

Role of

Executive Officers

The Chief Executive Officer and Senior Vice President, Human

Resources recommend to the Committee the compensation program

design and award amounts for most executives. They are not

involved in determining their own pay.

Overview

of Executive Compensation Components

Our executive compensation program currently consists of the

following compensation elements:

|

|

|

| |

|

Base salary

|

| |

| |

|

Short-term cash incentives

|

| |

| |

|

Long-term incentives, consisting of Service Restricted Stock

Units (Service RSUs) and Performance Restricted Stock Units

(Performance RSUs)

|

| |

| |

|

Welfare benefits

|

| |

| |

|

Perquisites

|

| |

| |

|

Retirement benefits

|

| |

| |

|

Termination pay

|

Each of these elements is discussed below, as well as the

methodology used for setting the amount of each type of

compensation.

Base

Salary

Philosophy. Our philosophy is to set salaries

for our Executives at the 50th percentile of the peer

groups salaries for executives with similar positions and

responsibilities (with adjustments made to reflect the

13

various sizes of the companies in such group). Recent

promotions, however, have resulted in actual base salaries for

several of our Executives that are below the size-adjusted

50th percentile of the peer group.

Changes to base salaries occur on a periodic basis that is

generally at least twelve months after the most recent

adjustment for the Executive. Base salary changes take into

account market data for similar positions, the Executives

experience and time in position, any changes in responsibilities

and individual performance. Individual performance is determined

by considering achievement against each Executives

specific performance goals established at the beginning of each

year. Generally, such individual performance goals are

established to support the financial and operational goals

established by the Board for the Company, and may include

earnings before income taxes, depreciation and amortization

(EBITDA), debt reduction, new product innovation

targets, business unit revenue, profitability and cost-saving

goals and certain more subjective goals such as improvement in

culture, implementation of compliance initiatives and management

effectiveness.

Management

Incentive Plan

The purpose of the Management Incentive Plan (MIP)

is to provide a meaningful short-term cash incentive that

rewards the achievement of specified annual financial goals. For

2008, the financial measures used to set such financial goals or

targets were EBITDA and cash flow before debt reduction.

Target Opportunities. The MIP payout at the

target level for each Executive is set at a level that pays at

the 50th percentile of peer group companies for Company

performance at or above the 50th percentile of the peer

group.

Performance Goals. Because we set target

performance goals that we believe represent performance at or

above the 50th percentile of our peer group (confirmed

through historical analysis), achievement of such goals is

designed to pay base salary plus short-term incentive at

approximately the 50th percentile of the peer group. Should

the Company fail to reach target goals, the MIP will pay out to

a lesser degree. Payouts are discretionary on the part of the

Committee if the threshold goals are not met. Our performance

goals for 2008 were EBITDA of $504.7 million (weighted at

66.6% in the calculation) and cash flow before debt reduction of

$160 million (weighted at 33.3% in the calculation).

Achieving these performance goals would present an opportunity

for a MIP award at target. The payout for performance at 90% of

our EBITDA and cash flow goals was set at 50% of target, and no

payout would be earned for performance at or below 85% of our

EBITDA and cash flow goals. The payout for performance at 110%

or more of our EBITDA and cash flow goals (after appropriate

accrual for the greater compensation expense) was set at a

maximum of 200% of target.

Actual Short-Term Incentive Payouts for

2008. Actual short-term incentive payouts for

2008 are shown in the Non-Equity Incentive Plan Compensation

column of the Summary Compensation Table. Although the Company

surpassed the EBITDA and cash flow thresholds, it did not

achieve the target performance. Nevertheless, the Committee

reviewed the Companys performance in the midst of

significant inflation and unprecedented volatility in the

overall economy, including the Companys successful

completion of the Altivity Transaction and significant progress

on capturing anticipated synergies from such transaction, and

determined that payout of bonuses above the calculated amount

was appropriate. The Committee exercised its discretion and

awarded bonuses at up to 50% of the target level, depending on

individual performance.

Long-Term

Incentives

From 2005 through 2007, the Companys long-term incentive

program had two elements: Service RSUs and Performance RSUs.

Each represented about 50% of the competitive, total long-term

incentive value that the Company pays to its Executives. Both

types of grants were intended to retain Executives during a

multi-year vesting period, align the long-term interests of

Executives with our stockholders and provide cash and stock

compensation. A mandatory two-year holding period after vesting

was intended to further align our Executives interests

with those of our stockholders.

Service RSUs vested in three equal increments on the first,

second and third anniversaries of the date of grant and were

generally granted in late February or early March of each year.

Performance RSUs vested in

14

full on the second anniversary of the date of grant and were

generally granted in May based on performance during the

previous year. Both Service RSUs and Performance RSUs were

payable one-half in shares of our common stock and one-half in

cash two years after vesting upon the expiration of the

mandatory holding period.

2008 Payouts and Grants. In March 2008, as a

result of the Altivity Transaction, which constituted a

change of control under the 2004 Plan, all of the

RSUs previously granted under the Companys 2004 Plan were

immediately vested and the mandatory holding period with respect

to such RSUs expired. The Company paid out all of the RSUs

promptly following the consummation of the Altivity Transaction.

Because of the impending closing of the Altivity Transaction,

the Committee did not make new Service RSU grants in February

2008. The Committee did, however, approve in May 2008 the grant

of Performance RSUs relating to 2007 performance. The May 2008

Performance RSU grants were made at 112% of target, reflecting

the Companys performance in cost reduction, debt

reduction, innovation, process improvements and asset

utilization. These grants are reflected in the Summary

Compensation Table, and the Grants of Plan-Based Awards table.

Throughout 2008, the Committee discussed and evaluated a new

Long Term Incentive Program design. Such program will be

implemented in 2009.

Welfare

Benefit Plans

Executives participate in employee benefit plans available to

all employees, including medical, dental, accidental death and

dismemberment, business travel accident, prescription drug, life

and disability insurance. Continuation of welfare benefits for a

limited time may occur as part of severance upon certain

terminations of employment.

Perquisites

Employment contracts for the Executives provide to each a

$20,000 payment in lieu of perquisites that can be used as the

Executive determines. The fixed payment was designed to take the

place of other specific perquisites that existed in previous

employment contracts and to simplify administration. The payment

is reported in the Summary Compensation Table in the Bonus

column.

Retirement

Benefits

Executives and all other employees who meet certain service

requirements are eligible to participate in one of the

Companys 401(k) Plans, which are qualified defined

contribution plans under the rules of the Internal Revenue

Service (IRS). The Company does not currently offer

a 401(k) restoration plan that would permit Executives to

contribute to and receive contributions from the Company on a

basis that would be commensurate with other employees as a

percent of pay. Executives and all other employees hired on or

before January 1, 2008, are also eligible to participate in

either the Riverwood International Employees Retirement Plan or

the Graphic Packaging Retirement Plan and the Graphic Packaging

Excess Benefit Plan (together, the Pension Plans).

In addition, some senior executives participate in either the

Riverwood International Supplemental Retirement Plan or the

Graphic Packaging Supplemental Retirement Plan (together, the

Supplemental Plans). Mr. Scheible and

Mr. Doss participated in the Graphic Packaging Retirement

Plan and the Graphic Packaging Supplemental Plan until

January 1, 2005, the date they transferred into the

Riverwood International Employees Retirement Plan and the

Riverwood International Supplemental Retirement Plan. The

Supplemental Plans provide a benefit based upon compensation

that exceeds the limits set by the IRS for the Pension Plans and

makes total retirement benefits under the Companys defined

benefit plans for the Executives commensurate with those

available to other employees as a percent of pay. Additional

information about the Pension Plans and the Supplemental Plans

is provided under the Pension Benefits at 2008 Fiscal Year-End

table.

15

Employment

Agreements and Potential Payments on Termination

Executives have employment agreements with generally uniform

provisions. The agreements contain enforceable non-competition

and non-solicitation covenants as well as claims releases and

severance provisions.

The agreements also provide guaranteed severance benefits in the

event of certain terminations of employment. For

Mr. Scheible, the guaranteed severance is two times base

salary, and for Messrs. Blount, Doss, Hellrung, Schmal and

Simko it is one times base salary. Executives also receive

welfare benefits for one year after termination and a pro-rata

MIP payout (which is doubled for Mr. Scheible).

Executives may receive severance benefits if they are terminated

involuntarily or terminate voluntarily for Good Reason (as

defined below) within 30 days of the Good Reason event. The

Executive must deliver written notice of intention to terminate

for Good Reason, specifying the applicable provision, and

provide the Company a reasonable opportunity to cure. The Good

Reason provision in the 2006 contracts was designed to equalize

the treatment of voluntary terminations for Good Reason with

involuntary terminations without Cause. Doing so enables the

contracts to fulfill their purpose of promoting retention during

times of uncertainty and transition. Good Reason as

defined in the agreements includes contract termination,

material reduction in position, responsibilities or duties,

failure of a successor company to assume the agreement,

reduction in salary, breach of agreement or mandatory

relocation, other than in connection with promotion, of more

than 50 miles.

The agreements are discussed in more detail under Employment

Agreements and Termination of Employment Arrangements.

We have no

change-in-control

severance protections in the employment agreements and, because

the Company vested all outstanding options in December 2005,

certain other

change-in-control

provisions in the Companys equity compensation plans are

moot. However, the award agreements for the Service RSUs and

Performance RSUs granted under the 2004 Plan provide that all

vesting restrictions shall lapse and the mandatory holding

period shall expire upon the occurrence of a

change-in-control.

A

change-in-control

means any of the following events:

|

|

|

| |

|

The acquisition by any person of beneficial ownership of thirty

percent (30%) or more of the combined voting power of the then

outstanding voting securities of the Company entitled to vote

generally in the election of directors, except if such

acquisition is by a person who, prior to such acquisition, is

the beneficial owner of thirty percent (30%) or more of such

securities, or if such acquisition is by any employee benefit

plan or related trust, or if such acquisition is by a

stockholder who is party to the Riverwood Holding, Inc.

Stockholders Agreement dated March 25, 2003.

|

| |

| |

|

Individuals of the incumbent Board (other than those whose

initial assumption of office is in connection with an actual or

threatened election contest relating to the election or removal

of directors of the Company) do not constitute at least a

majority of the Board.

|

| |

| |

|

Consummation of a reorganization, merger or consolidation to

which the Company is a party unless (i) all or

substantially all of the individuals and entities who were the

Beneficial Owners of the Companys outstanding securities

prior to such transaction beneficially own more than fifty

percent (50%) of the combined voting power of the outstanding