PRE 14A: Preliminary proxy statement not related to a contested matter or merger/acquisition

Published on March 28, 2025

Table of Contents

☒ |

Preliminary Proxy Statement | |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐ |

Definitive Proxy Statement | |

☐ |

Definitive Additional Materials | |

☐ |

Soliciting Material Under Rule 240.14a-12

|

|

☒ |

No fee required. | |||

☐ |

Fee paid previously with preliminary materials. | |||

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|||

Table of Contents

Table of Contents

April 7, 2025

Dear Graphic Packaging Holding Company Stockholders:

It is my pleasure to invite you to Graphic Packaging Holding Company’s 2025 Annual Meeting of Stockholders, to be held at 1500 Riveredge Parkway, Atlanta, Georgia 30328, on Wednesday, May 21, 2025, at 10:00 a.m. local time.

The formal Notice of Annual Meeting and Proxy Statement are enclosed with this letter. The Proxy Statement describes the matters to be acted upon at the Annual Meeting. It also describes how our Board of Directors operates and provides compensation and other information about the management and Board of Directors of Graphic Packaging Holding Company.

Whether or not you plan to attend the Annual Meeting, your vote is important, and I hope you will vote as soon as possible. You may vote over the internet, by telephone or by mailing a proxy or voting instruction card. Voting over the internet, by telephone or by written proxy will ensure your representation at the Annual Meeting, regardless of whether you attend in person. If you hold your shares in your own name and choose to attend the Annual Meeting, you may revoke your proxy and personally cast your votes at the Annual Meeting. If you hold your shares through an account with a brokerage firm, bank or other nominee, please follow instructions from such firm to vote your shares.

Sincerely yours,

Michael P. Doss

President and

Chief Executive Officer

Table of Contents

Notice of 2025 Annual

Meeting of Stockholders

Annual Meeting of Stockholders

| Date and Time Wednesday, May 21, 2025 10:00 a.m. local time |

Location 1500 Riveredge Parkway Atlanta, Georgia 30328

|

Record Date March 24, 2025 |

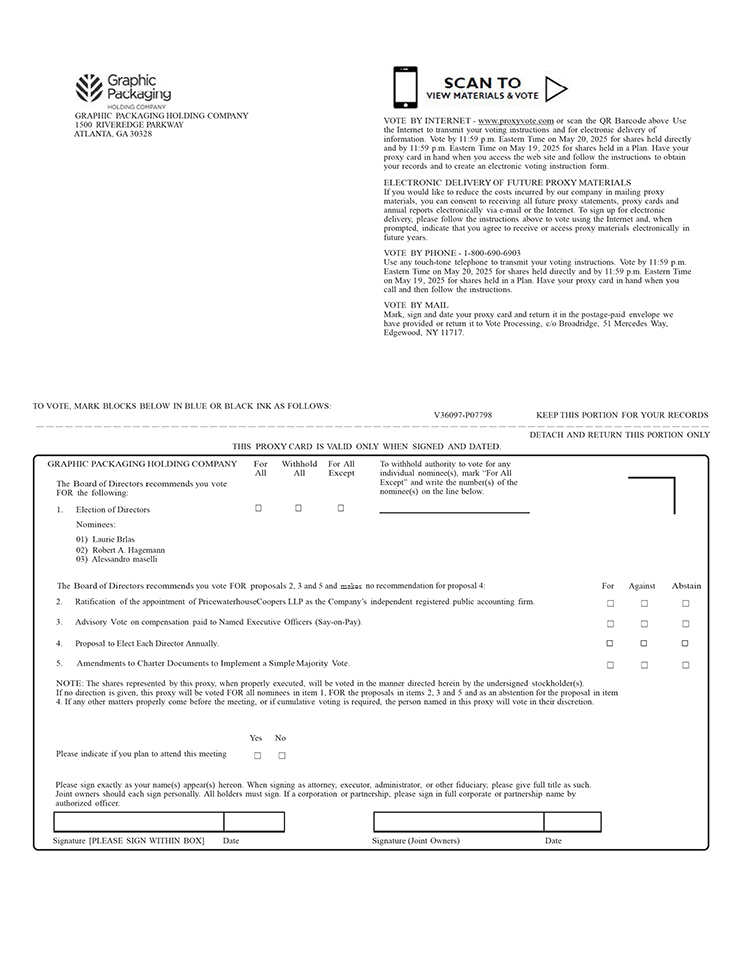

| Voting Matters

At the Annual Meeting of Stockholders, we will vote on the following proposals:

Proposal 1 Election of Directors

Proposal 2 Ratification of Independent Registered Public Accounting Firm

Proposal 3 Advisory Vote on Executive Compensation (Say-on-Pay)

Proposal 4 Elect Each Director Annually

Proposal 5 Amendments to Charter Documents to Implement a Simple Majority Vote |

How to vote:

|

|||||||||||

|

|

In Person

|

|

Internet

|

|||||||||

| If your shares are registered directly in your name, you are considered a stockholder of record and you may vote in person at the Annual Meeting. If your shares are held beneficially through a bank or brokerage firm, your shares are considered to be held beneficially in street name. If your shares are held beneficially in street name and you wish to vote in person at the Annual Meeting, you will need to obtain a proxy from the bank or brokerage firm that holds your shares. Please note that even if you plan to attend the Annual Meeting in person, the Company recommends that you vote before the Annual Meeting.

|

Stockholders of Record should follow the “Vote by Internet” instructions on their Proxy Card. Stockholders who hold their shares beneficially in street name should vote by accessing the website specified on the voting instruction card provided by their bank or brokerage firm. | |||||||||||

|

|

Telephone |

|

|

|||||||||

| Stockholders of Record should follow the “Vote by Phone” instructions on their Proxy Card. Stockholders who hold their shares beneficially in street name should vote by calling the number specified on the voting instruction card provided by their bank or brokerage firm. |

Stockholders of record should complete, sign, date and mail the Proxy Card in the envelope provided. Stockholders who hold their shares beneficially in street name should complete, sign, date and mail the voting instruction card provided by their bank or brokerage firm. | |||||||||||

YOUR VOTE IS VERY IMPORTANT.

EVEN IF YOU PLAN TO ATTEND THE ANNUAL MEETING OF STOCKHOLDERS IN PERSON, PLEASE AUTHORIZE YOUR PROXY OR DIRECT YOUR VOTE BY MAIL, INTERNET OR TELEPHONE AS DESCRIBED ABOVE.

Table of Contents

Table of Contents

| Compensation Discussion and Analysis | 23 | |||

| 23 | ||||

| 25 | ||||

| 26 | ||||

| 26 | ||||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| 30 | ||||

| 30 | ||||

| 31 | ||||

| 31 | ||||

| 31 | ||||

| 33 | ||||

| 33 | ||||

| 34 | ||||

| 35 | ||||

| 35 | ||||

| 35 | ||||

| Employment Agreements, |

36 | |||

| 37 | ||||

| 38 | ||||

| Compensation of Executive Officers |

39 | |||

| 39 | ||||

| Additional Information |

40 | |||

| 40 | ||||

| 41 | ||||

| 42 | ||||

| 43 | ||||

| 43 | ||||

| Page i | 2025 Proxy Statement |

|

Table of Contents

| Helpful Resources

Where You Can Find More Information

Annual Meeting Information

|

| Proxy Statement: https://investors.graphicpkg.com/company-information/annual-reports-proxy

Annual Report: https://investors.graphicpkg.com/company-information/annual-reports-proxy

Voting Your Proxy via the Internet Before the Annual Meeting: www.proxyvote.com

Board of Directors

|

| https://investors.graphicpkg.com/corporate-governance/board-of-directors

Communications with the Board

|

| The process for communicating with one or more members of the Board is to send such communications to the address below indicating which members of the Board should receive such communication. The Chairman of the Board will then relay such communication as requested.

Graphic Packaging Holding Company 1500 Riveredge Parkway Atlanta, Georgia 30328 Attn: Chairman of the Board

Governance Documents

|

| https://investors.graphicpkg.com/corporate-governance/governance-documents

• Corporate Governance Guidelines

• Committee Charters

• Selected Corporate Policies and Disclosures

|

| Code of Business Conduct and Ethics

|

| graphicpkg.com/disclosures-and-company-policies/code-of-business-conduct-ethics/ |

|

Investor Relations

|

| https://investors.graphicpkg.com

Sustainability

|

| https://www.graphicpkg.com/sustainability/ |

|

|

2025 Proxy Statement | Page ii |

Table of Contents

Definition of Certain Terms or Abbreviations

| 2021 ADJUSTED EBITDA | 2021 ADJUSTED EBITDA, as defined in the 2021 grant agreements for Performance Restricted Stock Units, is consolidated net income of Graphic Packaging Holding Company before equity income of unconsolidated subsidiaries, interest expense, and depreciation and amortization, as adjusted for: expenses related to merger, acquisition and disposition activities; refinancing or early retirement of debt; acquisition integration costs; and asset or goodwill write-downs (excluding inventory, receivables and write downs in the normal course of business); as well as other EBIDTA adjustments for asset retirement and disposal costs; restructuring or reorganization activities (including businesses held for sale) and other unusual items. All adjustments are approved by the Compensation and Management Development Committee.

|

|

| 2021 ROIC | 2021 ROIC or Return on Invested Capital, as defined in the 2021 grant agreements for Performance Restricted Stock Units, is consolidated net income of Graphic Packaging Holding Company before equity income of unconsolidated subsidiaries, interest expense and income tax expense, as adjusted for: expenses related to merger, acquisition and disposition activities, refinancing or early retirement of debt; acquisition integration costs; and asset or goodwill write-downs, and gain/loss from asset sales (Adjusted EBIT”) (including assets or businesses held for sale, but excluding inventory, receivables divided by Adjusted Net Debt plus adjusted Stockholder Equity, all as further adjusted for restructuring or reorganization activities. All adjustments are approved by the Compensation and Management Development Committee.

|

|

| 2024 ADJUSTED EBITDA | As used as a performance metric for 2023 Management Incentive Plan Awards is consolidated net income of Graphic Packaging Holding Company before equity income of unconsolidated subsidiaries, interest expense, income tax expense, and depreciation and amortization, as adjusted for: expenses related to merger, acquisition and disposition activities; refinancing or early retirement of debt; acquisition integration costs; and asset or goodwill write- downs (excluding inventory, receivables and write downs in the normal course of business); as well as other EBITDA adjustments for restructuring or reorganization activities (including businesses held for sale), costs related to significant non-routine capital activities and other unusual one-time items. If an acquisition or a vestiture occurs that was not previously included in setting the MIP performance measures, the performance measures will be changed to reflect the expected impact on Adjusted EBITDA including synergies. Actual Adjusted EBITDA will be calculated on a Constant currency basis consistent with the performance measure. All adjustments are subject to approval by the Compensation and Management Development Committee.

|

|

| 2024 CASH FLOW BEFORE DEBT REDUCTION | As used as a performance metric for 2024 Management Incentive Plan Awards is the year-over-year change in Graphic Packaging Holding Company net debt, as adjusted for merger, acquisition, disposition, share repurchase, asset sales, dividend and capital market activities, as well as other Cash Flow before Debt Reduction adjustments for restructuring or reorganization activities (including businesses held for sale) and other

|

|

| one-time unusual items. If an acquisition or divestiture occurs that was not previously included in setting the MIP performance measures, the Cash Flow Before Debt Reduction performance measure will be changed to reflect the expected impact on Cash Flow Before Debt Reduction including synergies. Actual Cash Flow before Debt Reduction will be calculated on a constant currency basis consistent with the performance measure. All adjustments are subject to approval by the Compensation and Management Development Committee.

|

||

| BOARD | The Board of Directors of Graphic Packaging Holding Company

|

|

| CEO | Chief Executive Officer

|

|

| CFO | Chief Financial Officer

|

|

| GPHC | Graphic Packaging Holding Company, a Delaware corporation

|

|

| CRB | Coated Recycled Board

|

|

| ESG | Environmental, Social and Governance Matters

|

|

| FYE | Fiscal Year End

|

|

| GAAP | Generally Accepted Accounting Principles in the United States

|

|

| LTIR | Lost Time Injury Rate

|

|

| LTIP | Long-Term Incentive Program

|

|

| MIP | Management Incentive Plan

|

|

| NEO | Named Executive Officer

|

|

| NET DEBT | Total Debt (Short-Term Debt, Long-Term Debt and Current Portion of Long-Term Debt) less Cash and Cash Equivalents

|

|

| NET LEVERAGE | Total Debt divided by Adjusted EBITDA

|

|

| NET ORGANIC SALES | The Company’s net sales less open market paperboard sales (Paperboard Mills Segment) less impact of purchased sales from acquisitions less impact of pricing from converting sales, including price recovery from acquisitions less impact of foreign exchange

|

|

| NYSE | New York Stock Exchange

|

|

| ORGANIC REVENUE GROWTH | The percentage growth of organic revenue as defined by Net Sales – Open Market Sales – Sales from acquisitions closed with the last 12 months – FX impact

|

|

| PEO | Principal Executive Officer

|

|

| PFO | Principal Financial Officer

|

|

| RECORD DATE | March 24, 2025

|

|

| RSU | Restricted Stock Unit

|

|

| SEC | Securities and Exchange Commission

|

|

| Page iii | 2025 Proxy Statement |

|

Table of Contents

Proxy Summary

This summary provides an overview of key information in this Proxy Statement. We encourage you to read the entire Proxy Statement before voting.

ANNUAL MEETING OF STOCKHOLDERS

| Date and Time: | Wednesday, May 21, 2025, 10:00 a.m. local time | |

| Location: | 1500 Riveredge Parkway Atlanta, Georgia 30328 |

|

| Record Date: | March 24, 2025 | |

VOTING MATTERS

|

|

|

Board Recommendation | Page | |||

| Proposal No. 1: | Election of Directors | Vote FOR each nominee | 11 | |||

| Proposal No. 2: | Ratification of Independent, Registered Public Accounting Firm | Vote FOR ratification | 22 | |||

| Proposal No. 3: | Advisory Vote on Executive Compensation | Vote FOR approval | 50 | |||

| Proposal No. 4: | Elect Each Director Annually | No recommendation | 50 | |||

| Proposal No. 5: | Amendments to Charter Documents to Implement a Simple Majority Vote | Vote FOR approval | 51 | |||

2024 CORPORATE GOVERNANCE HIGHLIGHTS

| ➤ | Currently separate Chairman of the Board and CEO structure |

| ➤ | No Director may serve on more than three other Boards of Directors, and the CEO may serve on no more than one other public company Board of Directors |

| ➤ | Director nominees who receive a majority of withhold votes are required to resign, subject to acceptance of such resignation by the Board |

| ➤ | Board mandatory retirement age of 72 |

| ➤ | Directors and senior officers are subject to stock ownership guidelines |

| ➤ | Annual stockholder vote on “Say-on-Pay” |

| ➤ | No stockholder rights plan or “poison pill” |

| ➤ | Oversight of cybersecurity risks, mitigation efforts and incident disclosures delegated to the Audit Committee |

| ➤ | Oversight of ESG expressly delegated to the Nominating and Corporate Governance Committee |

| ➤ | Oversight of Company culture initiatives expressly delegated to the Compensation and Management Development Committee |

2024 BUSINESS HIGHLIGHTS

| ➤ | Launched Vision 2030 |

| ➤ | Delivered Adjusted EBITDA Margin of 19.1% |

| ➤ | Achieved Innovation Sales Growth of $205 million |

| ➤ | Returned $322 million of capital to stockholders through dividends and share repurchases |

| (1) | Adjusted EBITDA Margin is defined and reconciled to the most applicable GAAP measure in the Company’s earnings release for the fourth quarter and full year 2024, filed with the SEC as Exhibit 99 to the Company’s Report on Form 8-K filed on February 4, 2025. |

|

|

2025 Proxy Statement | Page iv |

Table of Contents

Proxy Statement

for the

Annual Meeting of Stockholders

on

May 21, 2025

General Information

ANNUAL MEETING AND VOTING INFORMATION

This Proxy Statement is being furnished in connection with the solicitation by the Board of Graphic Packaging Holding Company of proxies to be voted at the 2025 Annual Meeting of Stockholders (the “Annual Meeting”). This Proxy Statement and the enclosed proxy card or notice of availability on the Internet will first be sent on or before April 7, 2025 to the Company’s stockholders of record as of the close of business on the Record Date. References in this Proxy Statement to the “Company,” “Graphic Packaging,” “GPHC,” “we,” “us,” and “our” or similar terms are to Graphic Packaging Holding Company.

Outstanding Shares

As of the close of business on the Record Date, there were 301,754,281 shares of the Company’s common stock outstanding and entitled to vote. Stockholders are entitled to one vote for each share held on all matters to come before the Annual Meeting.

Who May Vote

Only stockholders who held shares of the Company’s common stock at the close of business on the Record Date are entitled to notice of and to vote at the Annual Meeting or any adjournment thereof.

How Proxies Work

The Board of Directors is asking for your proxy. By giving the Board your proxy, your shares will be voted at the Annual Meeting in the manner you direct. If you return a signed proxy but do not specify how you wish to vote your shares, your shares will be voted “FOR” the election of each of the Director nominees, “FOR” the approval of the ratification of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm, “FOR” the proposal to approve the compensation paid to the Company’s named executive officers, and “FOR” the amendments to the Company’s Charter documents to implement a simple majority vote. Your shares will not be voted with respect to the proposal to elect each Director annually. The proxyholders will vote shares according to their discretion on any other matter properly brought before the Annual Meeting.

If for any reason any nominee for election as Director is unable or declines to serve as a Director, discretionary authority may be exercised by the proxyholders to vote for a substitute proposed by the Board.

If the shares you own are held beneficially in street name by a bank or brokerage firm, such firm, as the record holder of your shares, is required to vote your shares according to your instructions. To vote your shares, you will need to follow the directions your bank or brokerage firm provides to you. Under the rules of the NYSE, if you do not give instructions to your bank or brokerage firm, it will still be able to vote your shares with respect to certain “discretionary” items, but will not be allowed to vote your shares with respect to certain “non-discretionary” items. In the case of non-discretionary items, the shares will be treated as “broker non-votes.” Banks and brokerage firms are allowed to exercise discretionary voting authority for beneficial owners who have not provided voting instructions only with respect to Proposal 2 set forth in this Proxy Statement and not with respect to any other proposal to be voted on at the Annual Meeting.

|

|

2025 Proxy Statement | Page 1 |

Table of Contents

General Information

How to Vote Your 401(k) Plan Shares

If you participate in the Company’s 401(k) Savings Plan or the Company’s Hourly 401(k) Savings Plan (the “401(k) Plans”), you may give voting instructions as to the number of share equivalents held in your account as of the Record Date to the trustee of the 401(k) Plans. You provide voting instructions to the trustee, Fidelity Management Trust Company, by completing and returning the proxy card accompanying this Proxy Statement. The trustee will vote your shares in accordance with your duly executed instructions if received by 11:59 p.m. Eastern Time on May 16, 2025. If you do not send instructions, the trustee will not vote the number of share equivalents credited to your account.

You may also revoke voting instructions previously given to the trustee by filing either a written notice of revocation or a properly completed and signed proxy card bearing a later date with the trustee no later than 11:59 p.m. Eastern Time on May 16, 2025. Your voting instructions will be kept confidential by the trustee.

Quorum

In order to carry out the business of the Annual Meeting, there must be a quorum. This means that at least a majority of the outstanding shares eligible to vote must be represented at the Annual Meeting, either by proxy or in person. Proxies received but marked as abstentions and broker non-votes will be included in the calculation of the number of votes present at the Annual Meeting for purposes of calculating whether a quorum is present.

Votes Needed

The Director nominees receiving the largest number of votes cast are elected, up to the maximum number of Directors fixed by the Board to be elected at the Annual Meeting. As a result, any shares not voted, whether by abstention, broker non-vote or otherwise, have no effect on the election of Directors, except to the extent that the failure to vote for a particular nominee may result in another nominee receiving a larger number of votes. However, under the Company’s Corporate Governance Guidelines, a nominee for director who receives a greater number of votes “withheld” than “for” is expected to tender his or her resignation to the Board promptly following certification of the election results. The Nominating and Corporate Governance Committee will consider any resignation tendered under this policy and recommend to the Board whether to accept or reject it. The Board will act on such resignation within 90 days following the certification of election results. A Director who tenders his or her resignation will not participate in the Nominating and Corporate Governance Committee’s recommendation or in the Board’s decision regarding whether to accept such resignation. Approval of Proposals 2, 3, and 4 requires the affirmative vote of holders of a majority of the shares present in person or by proxy and entitled to vote on such matter at the Annual Meeting. Approval of Proposal 5 requires the affirmative vote of 75% of the holders of the shares present in person or by proxy and entitled to vote on such matter at the Annual Meeting. An abstention with respect to these matters will have the effect of a vote against such proposal and broker non-votes will have no effect, as broker non-votes are not treated as shares entitled to vote.

Changing Your Vote

Shares of the Company’s common stock represented by proxy will be voted as directed unless the proxy is revoked. Any proxy may be revoked before it is exercised by sending an instrument revoking the proxy or a proxy bearing a later date to the Company’s Corporate Secretary. Any notice of revocation should be sent to: Graphic Packaging Holding Company, 1500 Riveredge Parkway, Atlanta, Georgia 30328, Attention: Corporate Secretary. Any proxy submitted over the Internet or by telephone may also be revoked by submitting a new proxy over the Internet or by telephone. A proxy is also revoked if the person who executed the proxy is present at the Annual Meeting and elects to vote in person. If you hold your shares through an account with a brokerage firm, bank or other nominee, please follow instructions from such firm to change or revoke your proxy.

Attending in Person

Only stockholders, their designated proxies and guests of the Company may attend the Annual Meeting. If your shares are held beneficially in street name, you must bring an account statement or letter from your brokerage firm or bank showing that you are the beneficial owner of shares of the Company’s common stock as of the Record Date in order to be admitted to the Annual Meeting.

| Page 2 |

2025 Proxy Statement |

|

Table of Contents

General Information

Internet Availability of this Proxy Statement and Form 10-K

The Company’s Proxy Statement, 2024 Annual Report to Stockholders and 2024 Annual Report on Form 10-K are available on the Company’s website at https://investors.graphicpkg.com/company-information/annual-reports-proxy.

ANNUAL REPORT

The Company’s 2024 Annual Report accompanies this Proxy Statement. The Form 10-K for the fiscal year ended December 31, 2024 for GPHC is included in the Annual Report and is available without charge upon written request addressed to Graphic Packaging Holding Company, Investor Relations, 1500 Riveredge Parkway, Atlanta, Georgia 30328. The Company will also furnish any exhibit to the Form 10-K for the fiscal year ended December 31, 2024, if specifically requested.

|

|

2025 Proxy Statement | Page 3 |

Table of Contents

Corporate Governance Matters

INFORMATION REGARDING THE BOARD OF DIRECTORS

Members, Standing Committees and Meetings of the Board of Directors

The table below shows the current members and chairs of the Board of Directors and each standing committee of the Board, the tenure and independence status of each Board member, the Audit Committee Financial Expert status of the members of the Audit Committee and the number of Board and committee meetings held during 2024.

| Director |

Tenure on Board of Directors |

Board of Directors |

Audit Committee |

Compensation and Management Development Committee |

Nominating and Corporate Governance Committee |

|||||||

| Aziz Aghili* |

3.1 Years | ● | ● | ● |

|

|||||||

| Laurie Brlas |

6.2 Years | ● |

|

● | ● | |||||||

| Andrew P. Callahan*† |

.7 Year | ● | ● | ● |

|

|||||||

| Michael P. Doss# |

9.9 Years | ● |

|

|

|

|||||||

| Robert A. Hagemann* |

10.9 Years | ● | ● |

|

● | |||||||

| Philip R. Martens |

11.4 Years | C |

|

|

C | |||||||

| Mary K. Rhinehart* |

4.1 Years | ● | ● | ● |

|

|||||||

| Dean A. Scarborough* |

6.7 Years | ● | ● | ● |

|

|||||||

| Larry M. Venturelli* |

8.9 Years | ● | C |

|

● | |||||||

| Lynn A. Wentworth |

15.4 Years | ● |

|

C | ● | |||||||

| Number of Meetings |

|

|

|

5 | 6 | 5 | 3 | |||||

● Member C Chair # Non Independent * Financial Expert † Elected to the Board on July 19, 2024.

| Q. | How does Graphic Packaging determine which Directors are independent? |

| A. | For purposes of this Proxy Statement, “independent” and “independence” have the meanings set forth under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the rules and regulations adopted thereunder by the SEC, the corporate governance listing standards of the NYSE, and the Company’s Corporate Governance Guidelines, all as in effect from time to time. A Director will not qualify as independent unless the Board affirmatively determines that the Director has no material relationship with the Company (either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company). In addition, in accordance with the corporate governance listing standards of the NYSE, the Company will also apply the following standards in determining whether a Director is independent: |

| • | A Director who is an employee of the Company, or whose immediate family member serves as one of the Company’s executive officers, may not be deemed independent until three years after the end of such employment relationship. |

| • | A Director who receives, or whose immediate family member receives, more than $120,000 per year in direct compensation from the Company, other than Board and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service), may not be deemed independent until three years after he or she ceases to receive more than $120,000 per year in such compensation. Compensation received by a director for former service as an interim Chairman or Chief Executive Officer or other executive officer or compensation received by an immediate family member for service as one of the Company’s non-executive employees will not be considered in determining independence under this test. |

| • | A Director who is a partner or employee of a firm that is the Company’s internal or external auditor or whose immediate family member is a partner of such a firm or is a current employee of such a firm and personally works on the Company’s audit may not be deemed independent until three years after the end of the affiliation or the employment or auditing relationship. |

| Page 4 |

2025 Proxy Statement |

|

Table of Contents

Corporate Governance Matters

| • | A Director who is employed, or whose immediate family member is employed, as an executive officer of another company where any of the Company’s current executive officers at the same time serve on that company’s compensation committee may not be deemed independent until three years after the end of such service or the employment relationship. |

| • | A Director who is an employee, or whose immediate family member is an executive officer of a company that makes payments to, or receives payments from the Company for property or services in an amount which, in any single fiscal year, exceeds the greater of $1 million or 2% of such other entity’s consolidated gross revenues, may not be deemed independent until three years after falling below that threshold. |

Applying these standards, the Board of Directors determined that all of the Company’s Directors who served in 2024 were independent except Mr. Doss. Mr. Doss is not considered independent because he serves as an executive officer of the Company.

| Q. | What is the leadership structure of the Board of Directors? |

| A. | Pursuant to the Company’s By-Laws, the Chairman of the Board of Directors is elected from time to time by the members of the Board of Directors. The By-Laws do not require, and the Board of Directors does not have a specific policy with respect to, the separation of the roles of the Chairman of the Board and the Chief Executive Officer. The By-Laws provide that the Chairman of the Board shall preside over each meeting of the stockholders of the Company and the Board of Directors and may have other duties and powers as conferred upon the Chairman by the Board of Directors. In accordance with the Company’s Corporate Governance Guidelines, if the Chairman of the Board is the Chief Executive Officer, the independent directors are required to elect one independent director to serve as Lead Director. The Lead Director is responsible for, among other duties, assisting the Chairman in providing Board leadership and presiding over the regular executive sessions of the Board at which non-management Directors meet without management participation. |

| Mr. Philip A. Martens was elected by the Board to serve as Chairman on May 25, 2016, and has served as Chairman since that time. The Board believes that having an independent Board member serve as Chairman currently is appropriate. The Board believes that separating the roles of the Chairman and CEO is beneficial in part because it provides additional resources for managing the Board’s functions, as well as experienced, independent oversight of management. In general, our Chairman of the Board will work with our CEO and other Board members to determine the Board’s strategic priorities, while the CEO will be responsible for communicating the Board’s guidance to management and implementing the Company’s key strategic initiatives. |

| Q. | Did any of the Company’s Directors attend fewer than 75% of the meetings of the Board and their assigned committees? |

| A. | No. All of the Company’s Directors attended at least 94% of the meetings of the Board and their assigned committees during 2024. |

| Q. | What is the Company’s policy on Director attendance at annual meetings of stockholders? |

| A. | Directors are expected to attend each annual meeting of stockholders but are not required to do so. All of the then-serving members of the Board of Directors attended the 2024 annual meeting of stockholders. |

| Q. | Do the non-management Directors meet during the year in executive session? |

| A. | Yes, the non-management Directors met separately at regularly scheduled executive sessions during 2024 without any member of management being present. Mr. Martens, as Chairman, acted as the presiding Director at each executive session held by the Board. |

| Q. | What does the Audit Committee do? |

| A. | The purpose of the Audit Committee is to assist the Board in overseeing the financial matters of the Company, such as the Company’s financial statements, internal and independent auditors and audits, and other areas such |

|

|

2025 Proxy Statement | Page 5 |

Table of Contents

Corporate Governance Matters

| as legal and regulatory compliance that directly impact the Company’s financial and risk profile. The Committee is responsible for, among other things, assisting the Board in its oversight of: |

| • | the integrity of the Company’s financial statements; |

| • | compliance with legal and regulatory requirements; |

| • | systems of internal accounting and financial controls; |

| • | the performance of the annual independent audit of the Company’s financial statements; |

| • | the Company’s independent auditor’s qualifications and independence; |

| • | the performance of the internal audit function; |

the review and approval or ratification (if appropriate) of transactions with related parties; and

| • | the status of the Company’s information security, controls and reporting. |

| The Audit Committee is also responsible for preparing the Report of the Audit Committee in conformity with the rules of the SEC to be included in the proxy statement for the annual meeting of stockholders. |

| Q. | What does the Compensation and Management Development Committee do? |

| A. | The purpose of the Compensation and Management Development Committee is to ensure that the Company’s compensation, integrated talent management and succession planning programs support the growth and success of the Company without creating incentives that encourage unnecessary risk-taking. Specifically, the Compensation and Management Development Committee does the following: |

| • | establish and regularly review and approve all compensation and benefits plans and programs in which the CEO and the other executive officers participate; |

| • | review and approve all equity compensation plans; |

| • | evaluate the alignment between compensation philosophy, plan design and achievement of short and long-term financial and other results, including the development of a growth-oriented culture; |

| • | review the Company’s compensation practices, policies and programs for executive officers and other employees to ensure that they do not encourage unnecessary or excessive risk-taking; |

| • | annually review the Company’s integrated talent management and succession planning strategy; |

| • | direct the annual process for evaluating the CEO’s performance and compensation; |

| • | annually review and approve all compensation arrangements of the executive officers; |

| • | evaluate and approve awards of restricted stock units or other types of equity compensation; |

| • | review the Company’s retirement and savings plans from time to time; and |

| • | annually review compliance with the executive stock ownership requirements and clawback policy. |

| Q. | Did the Compensation and Management Development Committee engage a compensation consultant to assist it in making recommendations to the Board of Directors regarding the amount or form of compensation paid to executive officers? |

| A. | Yes, the Compensation and Management Development Committee engaged Willis Towers Watson US LLC (“WTW”) to serve as an independent compensation consultant to the Compensation and Management Development Committee. Representatives from WTW attended Compensation and Management Development Committee meetings and advised the Compensation and Management Development Committee on compensation trends, best practices and regulatory compliance issues, in addition to conducting executive compensation benchmarking analysis. While representatives from WTW work with members of management to collect information and prepare materials for the Compensation and Management Development Committee and assisted the Company in its compliance with the Pay versus Performance rules and calculations, such |

| Page 6 |

2025 Proxy Statement |

|

Table of Contents

Corporate Governance Matters

| representatives report directly to the Compensation and Management Development Committee and the decision to retain WTW is made solely by the Compensation and Management Development Committee. |

| Q. | Did WTW provide any services other than executive compensation advisory services in 2024? |

| A. | WTW was hired primarily to assist the Compensation and Management Development Committee in its review of executive compensation practices, including regulatory compliance issues. During 2024, WTW also provided information and support to the Committee and the Company with respect to calculation of the Total Shareholder Return (“TSR”) metric applicable to Performance-Based RSUs, the Pay versus Performance calculations, , modeling and drafting support related to the 2024 Omnibus Plan, market data and analysis for the Nominating and Corporate Governance Committee regarding compensation for non-employee directors, and access to ongoing education on a wide range of compensation and benefits topics. WTW also provided health and welfare benefits consulting and brokerage services to the Company, which are managed separately and not related to the executive compensation services provided to the Committee. |

| Q. | Does the Company have compensation policies and practices that create risks that are reasonably likely to have a material adverse effect on the Company? |

| A. | No, the Company does not believe its compensation policies and practices for its employees create risks that are reasonably likely to have a material adverse effect on the Company. The Company uses performance measures in its short-term and long-term incentive programs that encourage employees to focus on achieving Company-wide profitability and strategic goals. In addition, the design and payout of the Company’s incentive programs are reviewed annually by the Company’s compensation consultant for provisions or practices that might encourage unnecessary or excessive risk-taking and are subject to the review and approval of the Compensation and Management Development Committee and, with respect to the compensation of the President and CEO, the full Board of Directors. |

| Q. | Does the Compensation and Management Development Committee have any interlocks with other compensation committees? |

| A. | Ms. Brlas, Ms. Rhinehart and Ms. Wentworth, as well as Messrs. Aghili, Callahan and Scarborough served as members of the Compensation and Management Development Committee during 2024. None of these members is or has ever been an officer or employee of the Company. No member had any relationship requiring disclosure as a compensation committee interlock during 2024. |

| Q. | What does the Nominating and Corporate Governance Committee do? |

| A. | The Nominating and Corporate Governance Committee is responsible for, among other things, identifying qualified individuals for nomination to the Board, recommending new members to the Board, providing orientation and training for new directors, developing and recommending a set of corporate governance principles to the Board, and overseeing the annual evaluations of the Board and its committees and management. In addition, the Nominating and Corporate Governance Committee is responsible for reviewing the Company’s policies and practices for consistency with its responsibility for ESG matters and oversees the Company’s ESG programs and publications. |

| Q. | What steps does the Board take to exercise its oversight responsibility for the Company’s strategic direction and progress toward achieving its Vision 2030 financial and sustainability goals? |

| A. | The Board reviews the Company’s strategic direction and initiatives each year when it reviews and approves the Company’s long-range plan. The Board will review and evaluate the Company’s progress toward achieving its Vision 2030 sustainability goals each year when it reviews and approves the annual operating plan. In addition, each of the standing committees of the Board reviews and evaluates specific financial, operational and reputational risks that could affect the Company’s ability to meet its financial and sustainability goals. |

|

|

2025 Proxy Statement | Page 7 |

Table of Contents

Corporate Governance Matters

BOARD AND COMMITTEE OVERSIGHT OF RISK MANAGEMENT

| Full Board

As set forth in the Company’s Corporate Governance Guidelines, the Board is responsible for reviewing, approving and monitoring business strategies and financial performance, and ensuring processes are in place for maintaining the integrity of the Company in financial reporting, legal and ethical compliance matters, and in relationships with customers, suppliers, employees, the community and stockholders. The Board fulfills these responsibilities through a number of different practices, including the approval of each annual operating plan and long-term strategic plan, the review of actual results against such plans at each regular Board meeting, and specific review and approval of significant corporate actions such as acquisitions and divestitures, plant rationalizations and major projects involving significant capital spending. In addition, the Board oversees areas of particular risk through its Audit Committee, Compensation and Management Development Committee and Nominating and Corporate Governance Committee, each of which provides a report to the full Board of Directors at each regular Board meeting. |

||||||||

|

|

|

|

||||||

|

Audit Committee

The Audit Committee has oversight responsibility for the quality and integrity of the Company’s financial statements, the performance of the Company’s internal audit function and the Company’s compliance with legal and regulatory requirements. To fulfill these responsibilities, the Audit Committee routinely discusses and evaluates (i) audit findings and issues with the Company’s Chief Financial Officer and independent auditors, (ii) internal controls, processes and issues with the Company’s Senior Vice President and Chief Audit Risk and Compliance Officer (who reports directly to the Chairman of the Audit Committee and the Chief Financial Officer), (iii) legal and regulatory compliance issues with the Company’s Executive Vice President, General Counsel and Secretary, and (iv) the status of the Company’s information security and controls with the Company’s Chief Information Officer. The Committee also periodically reviews and evaluates the Company’s policies with respect to risk assessment and risk management, including discussion of the Company’s major financial risk exposures and the steps that management has taken to monitor and control such exposures. The Board has also delegated to the Audit Committee oversight responsibility for the Company’s information security, controls and reporting. In addition to these activities, the Audit Committee reviews each of the Company’s Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q and has the opportunity to discuss such reports with management of the Company and the Company’s independent auditors prior to the filing of such reports with the SEC.

|

Compensation and Management Development Committee

The Compensation and Management Development Committee has oversight responsibility for any risks to the Company inherent in the structure of the Company’s compensation programs for its employees. Pursuant to its Charter, the Compensation and Management Development Committee reviews and approves the Company’s general compensation philosophy, incentive and equity compensation plans, health and welfare plan offerings and retirement plans for all employees to ensure that they do not encourage unnecessary or excessive risk-taking. In addition, the Compensation and Management Development Committee reviews and approves all compensation arrangements and awards relating to the Company’s executive officers, with all compensation arrangements of the President and CEO of the Company being reviewed and approved for recommendation to the full Board of Directors for final approval. Through its review of these programs and arrangements, as well as its oversight of the Company’s talent management and succession practices, the Compensation and Management Development Committee and the Board has visibility into and exercises oversight over the financial and other risks, such as retention of key management and the ability to attract, retain, motivate, and reward high-performing talent, affected by the Company’s compensation and benefits programs. |

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee has oversight responsibility for Board and Committee succession, as well as Board members’ and Board and Committee Chair compensation. In addition, the Nominating and Corporate Governance Committee reviews and recommends policies and practices such as the stockholding guidelines for directors and senior executives. The Nominating and Corporate Governance Committee also reviews the Company’s policies and practices for consistency with its responsibility for ESG matters and oversees the Company’s ESG programs and publications, such as the annual ESG report. |

||||||

| Page 8 |

2025 Proxy Statement |

|

Table of Contents

Corporate Governance Matters

OVERSIGHT OF ESG MATTERS

ESG matters inform our decisions about how we operate and grow our business, protect our environment and support our employees. In recognition of the importance of ESG matters to the Company, we believe that a two-tiered level of oversight provides the best structure to integrate consideration of ESG risks and opportunities into our overall business strategy and help us meet the changing demands of all our stakeholders – stockholders, customers, employees and communities. Our Board of Directors is responsible for the oversight of our sustainability strategy, governance standards, goals and performance and has assigned principal oversight of our sustainability policy and practices to the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee considers current and emerging social and environmental trends, as well as major legislative and regulatory developments and other public policy issues that may impact our business operations or stakeholders. The Committee also reviews the Company’s policy and practices for consistency with its ESG commitments, including goals, performance metrics, and public reporting and makes recommendations to the Board and management. In addition, oversight of governance matters such as enterprise risk management and cybersecurity risk, as well as oversight of controls and procedures related to reporting ESG data, are assigned to the Audit Committee, while oversight of a range of human capital and social matters related to the effective recruitment, development and retention of talent necessary to support the long-term success of the Company is the responsibility of the Compensation and Management Development Committee.

In August 2024, the Company published its 2023 ESG Report, which is available on the Company’s website at www.graphicpkg.com/sustainability/sustainability-reporting. In addition, in 2024 the Company was recognized for the third year in a row by Fortune as one of the world’s most admired companies, announced its ambition to achieve net zero greenhouse gas emissions by 2050, and reaffirmed its commitment as a participant in the UN Global Compact.

COMPANY CULTURE AND ENGAGEMENT INITIATIVES

Graphic Packaging works to enable a safe, engaged, and customer-focused culture, and has a solid record of delivering outstanding results for its customers across the globe. As a leading innovator in consumer packaging, a deep understanding of the widest range of consumers is essential to the success of our designs and product execution for our customers. As such, the Company seeks to recruit and retain talented employees whose perspectives and experience are broadly representative of the consumers our customers serve.

Similarly, strong relationships with the communities in which the Company operates have a substantial impact on hiring costs, retention rates, employee engagement, operating performance and safety. The Company therefore seeks to build and maintain strong and capable teams broadly representative of those communities. The Company believes that its recent safety performance is among the best in the industry, and considers employee engagement to be critical to maintaining and improving upon that level of safety performance.

The Compensation and Management Development Committee of our Board of Directors annually reviews the processes and practices related to talent and engagement to ensure the equitable treatment of all employees, and alignment with the Company’s strategic objectives.

Our employees play a crucial role as well, and we rely on their insights and feedback to assess our culture and identify areas for improvement. In 2024, we conducted a global employee engagement survey in partnership with Gallup, resulting in 87% of our employees sharing their voice – a significant increase in participation compared to the previous year. The results of this survey were shared with our entire employee population, and action plans have been created at the local level in facilities around the globe to identify and execute opportunities to enhance the employee experience. The Company has a number of initiatives underway to drive employee engagement higher.

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

The Board recognizes that Related Party Transactions (as defined below) can present potential or actual conflicts of interest and create the appearance that Company decisions are based on considerations other than the best interests of the Company and its stockholders. In March 2007, the Board of Graphic Packaging Corporation (the publicly-traded predecessor to the Company, “GPC”) delegated authority to the Audit Committee to review and approve Related Party Transactions, and the Audit Committee has adopted a Policy Regarding Related Party Transactions.

|

|

2025 Proxy Statement | Page 9 |

Table of Contents

Corporate Governance Matters

The Policy Regarding Related Party Transactions defines a “Related Party Transaction” as any transaction, arrangement or relationship (including any indebtedness or guarantee of indebtedness) in which (a) the aggregate amount involved will or may be expected to exceed $120,000 in any fiscal year, (b) the Company is a participant, and (c) any Related Party (as defined below) has or will have a direct or indirect interest, other than an interest that arises solely as a result of being a director or beneficial owner of less than 10% of another entity. The policy defines a “Related Party” as any (a) person who is or was since the beginning of the last fiscal year an executive officer, director or nominee for election as a director of the Company, (b) any beneficial owner of more than 5% of the Company’s common stock, (c) an immediate family member of any of the foregoing, or (d) any firm, corporation or other entity in which any of the foregoing is employed, is a principal or serves in a similar position, or has a beneficial ownership of more than 5%.

The Policy Regarding Related Party Transactions provides that the Audit Committee shall review all of the material facts and circumstances of all Related Party Transactions and either approve, ratify or disapprove of the entry into the Related Party Transaction. In determining whether to approve a Related Party Transaction, the Audit Committee will take into account, among other factors it deems appropriate, whether the Related Party Transaction is on terms no less favorable than terms generally available to an unaffiliated third-party under the same or similar circumstances, the benefits to the Company, the extent of the Related Party’s interest in the transaction, and if the Related Party is a director or a nominee for director, the impact on such director’s independence. The policy provides that certain Related Party Transactions, including certain charitable contributions, transactions involving competitive bids and transactions in which all stockholders receive proportional benefits, are pre-approved and do not require an individual review by the Audit Committee. You may find a copy of the Policy Regarding Related Party Transactions on the Company’s website at www.graphicpkg.com/corporate-governance/governance-documents.

GOVERNANCE DOCUMENTS

The Company will provide printed copies of the charters of the Audit Committee, Compensation and Management Development Committee and Nominating and Corporate Governance Committee, as well as the Policy Regarding Related Party Transactions, the Code of Business Conduct and Ethics and the Corporate Governance Guidelines to any person without charge upon request.

| Page 10 |

2025 Proxy Statement |

|

Table of Contents

Proposal 1 — Election of Directors

The Company’s Board of Directors currently has ten members divided into three classes, with one class being elected each year for a three-year term. The three nominees standing for election as Class III Directors are: Ms. Brlas, Mr. Hagemann and Mr. Alessandro Maselli. Ms. Rhinehart, currently a member of the Board, is not standing for re-election.

If elected, each Class III nominee will serve three consecutive years with the term expiring in 2028 and until a successor is elected and qualified. The election of the Director nominees is by plurality vote, which means that the three nominees receiving the highest number of affirmative votes will be elected. Under the Company’s Corporate Governance Guidelines, any nominee who receives a greater number of votes “withheld” than “for” votes in an uncontested election is expected to tender to the Board his or her resignation as a Director promptly following certification of the election results. The Nominating and Corporate Governance Committee will then consider such resignation and recommend to the Board whether to accept or reject it and the Board will act on such resignation within 90 days following the certification of election results.

If at the time of the Annual Meeting, any of the nominees identified above is unable or unwilling to serve as a Director for any reason, which is not expected to occur, the persons named as proxies will vote for such substitute nominee or nominees, if any, as shall be designated by the Board.

Set forth below is certain information regarding the Director nominees and each of the incumbent Directors whose term will continue after the Annual Meeting, including the particular experience, qualifications and skills that led the Board to conclude that the Director nominee or incumbent Director is qualified to serve as a Director of the Company. There are no family relationships among any Directors or executive officers of the Company.

INFORMATION CONCERNING THE NOMINEES

Class III Directors — Terms to Expire in 2028

|

Laurie Brlas

Former Executive

|

Biographical Information: Laurie Brlas, 67, joined the Company’s Board on January 11, 2019. In December 2016, Ms. Brlas retired from Newmont Mining Corporation (“Newmont”), a mining industry leader in value creation and sustainability. Ms. Brlas joined Newmont in 2013 and served as Executive Vice President and Chief Financial Officer until October 2016. From 2006 through 2013, Ms. Brlas held various positions of increasing responsibility with Cliffs Natural Resources, most recently she served as Chief Financial Officer and then as Executive Vice President and President, Global Operations. Prior to that, Ms. Brlas served as Senior Vice President and Chief Financial Officer of STERIS Corporation from 2000 through 2006 and from 1995 through 2000, Ms. Brlas held various positions of increasing responsibility with Office Max, Inc. Most recently, Ms. Brlas served as Senior Vice President and Corporate Controller. Ms. Brlas currently serves on the Board of Directors of Albemarle Corporation, a specialty chemical company, and Autoliv, Inc., a global automotive safety supplier.

Qualifications: The Board concluded that Ms. Brlas is qualified to serve as a Director of the Company because of her previous executive leadership roles at several large public companies, including serving as Executive Vice President and Chief Financial Officer of Newmont Mining Corporation, as well as her extensive board and corporate governance experience on a number of public boards of directors.

|

|

|

|

2025 Proxy Statement | Page 11 |

Table of Contents

Proposal 1 — Election of Directors

|

Robert A.

Former Senior Vice

|

Biographical Information: Robert A. Hagemann, 68, joined the Company’s Board on May 21, 2014. Mr. Hagemann, who is currently retired, was most recently Senior Vice President and Chief Financial Officer of Quest Diagnostics Incorporated (“Quest”) from May 2003 to July 2013. Prior to that, Mr. Hagemann served as Vice President and Chief Financial Officer of Quest from August 1998. Mr. Hagemann joined a predecessor company, Corning Life Sciences, Inc. (“Corning”), a subsidiary of Quest’s former parent, Corning Incorporated, in 1992, and held a variety of senior financial positions before being named Vice President and Corporate Controller of Quest in 1996. Prior to joining Corning, Mr. Hagemann was employed by Prime Hospitality, Inc. and Crompton & Knowles, Inc. in senior financial positions. He was also previously employed by Arthur Young & Co., a predecessor company to Ernst & Young. Mr. Hagemann serves on the Board of Directors of Zimmer Biomet Holdings, Inc. and Ryder System, Inc.

Qualifications: The Board concluded that Mr. Hagemann is qualified to serve as a Director of the Company because of his 15 years of experience as the Chief Financial Officer of Quest Diagnostics, as well as his experience as a board member of both Zimmer Biomet Holdings, Inc. and Ryder System, Inc. Mr. Hageman serves as Chairman of the Audit Committee and a member of the Corporate Governance Committee for Zimmer Biomet Holdings, Inc. In addition, Mr. Hagemann serves as a member of the Audit Committee and the Finance Committee for Ryder System, Inc. Mr. Hagemann also has extensive acquisition experience, having completed and integrated numerous acquisitions over the course of his career.

|

|

|

Alessandro

Director, President and Chief Executive Officer

|

Biographical Information: Alessandro Maselli, age 53, has served as the President and Chief Executive Officer of Catalent Pharma Solutions and as a member of its Board of Directors since July 2022. He previously served as the company’s President & Chief Operating Officer since February 2019. Mr. Maselli joined Catalent in 2010 as Director of Operations at Catalent’s pharmaceutical, nutritional and cosmetics plant in Aprilia, Italy. In 2013, he was appointed General Manager of Zydis® operations at Catalent’s facility in Swindon, U.K, in 2015 he became Vice President of Operations, Europe, for Catalent’s Drug Delivery Solutions business unit, and in 2016 he was named Catalent’s Senior Vice President, Global Operations. Prior to his service at Catalent, Mr. Maselli held operational and business leadership roles at Alstom SA and SGS SA. From 1998 to 2006, he held roles of increasing responsibility from process engineer to operations director at ABB Group. Mr. Maselli began his career as an automation systems engineer in the food industry.

Qualifications: The Board concluded that Mr. Maselli is qualified to serve as a Director of the Company because he has over ten years of senior executive experience, including his current service as the President and Chief Executive Officer of Catalent, as well as experience leading European companies and operations. In addition, he currently serves as a director on a U.S. public company’s board of directors.

|

|

| Page 12 |

2025 Proxy Statement |

|

Table of Contents

Proposal 1 — Election of Directors

INFORMATION REGARDING CONTINUING DIRECTORS

Class I Directors — Terms to Expire in 2026

|

Andrew P.

Operating Advisor Clayton, Dublier & Rice, LLC

|

Biographical Information: Andrew (“Andy”) Callahan, 59, joined the Company’s Board on July 19, 2024. Andy is an Operating Advisor for Clayton Dublier & Rice, a private investment firm. Previously Mr. Callahan served as President, Chief Executive Officer and Executive Director of Hostess Brands until its acquisition by the JM Smucker Company in 2023. From 2014 to 2017, Mr. Callahan held two President-level roles at Tyson Foods, Inc., where he led its multi-billion dollar retail foodservice and international divisions and oversaw the integration of $8.4 billion acquisition of Hillshire Brands. Callahan served as President (Retail) at Hillshire Brands and in three senior leadership positions at Sara Lee Corporation, where he joined in 2009 following a 14-year career at Kraft Foods. Before joining Kraft Foods, Mr. Callahan was a Naval Flight Officer in the United States Navy. Mr. Callahan currently is serving as a Director at Harry’s Inc., a leading retail consumer products company.

Qualifications: The Board concluded that Mr. Callahan is qualified to serve as a Director of the Company because of his executive leadership experience at Kraft Foods, Sara Lee Corporation, Hillshire Brands, Tyson Foods, Inc. and Hostess Brands, all of which are leading food manufacturers in the United States. Mr. Callahan also has experience integrating large acquisitions, having overseen the integration of Hillshire Brands into Tyson Foods, Inc.

|

|

|

Michael P. Doss

President and Chief

|

Biographical Information: Michael P. Doss, 58, is the President and Chief Executive Officer of the Company. He was elected to the Board of Directors on May 20, 2015. Prior to January 1, 2016, Mr. Doss held the position of President and Chief Operating Officer from May 20, 2015 through December 31, 2015 and Chief Operating Officer from January 1, 2014 until May 19, 2015. Prior to these positions, he served as the Executive Vice President, Commercial Operations of the Company. Prior to this, Mr. Doss held the position of Senior Vice President, Consumer Packaging Division. Prior to March 2008, he served as Senior Vice President, Consumer Products Packaging of Graphic Packaging Corporation since September 2006. From July 2000 until September 2006, he was the Vice President of Operations, Universal Packaging Division. Mr. Doss was Director of Web Systems for the Universal Packaging Division prior to his promotion to Vice President of Operations. Since joining Graphic Packaging International Corporation in 1990, Mr. Doss has held positions of increasing management responsibility, including Plant Manager at the Gordonsville, TN and Wausau, WI plants. Mr. Doss serves on the Board of Directors for the American Forest & Paper Association, the Sustainable Forest Initiative, the Paper Recycling Coalition, the Atlanta Area Council of the Boy Scouts of America, the Metro Atlanta Chamber of Commerce, the Woodruff Arts Center, the American Bird Conservancy, and Regal Rexnord Corporation (RRX).

Qualifications: The Board concluded that Mr. Doss is qualified to serve as a Director of the Company because of his detailed knowledge of the Company and its business, having served in various senior management and operational roles with the Company or its predecessors since 1990. Mr. Doss also has significant financial management training, as he received a Master of Business Administration degree in Finance from Western Michigan University and has had supervisory responsibility for the Chief Financial Officer since becoming the President and Chief Executive Officer of Graphic Packaging Holding Company in January 2016.

|

|

|

|

2025 Proxy Statement | Page 13 |

Table of Contents

Proposal 1 — Election of Directors

|

Dean A.

Former Chief

|

Biographical Information: Dean A. Scarborough, 69, joined the Company’s Board on July 27, 2018. In May 2016, Mr. Scarborough retired as Chief Executive Officer of Avery Dennison Corporation (“Avery”), a leader in packaging and labeling solutions with $6 billion in annual sales. Mr. Scarborough joined Avery in 1983 and served in a series of positions of increasing responsibility. In 1990, he was promoted to Vice President and General Manager of Label and Packaging Materials’ North American division. Five years later, he moved to the Netherlands and led Label and Packaging Materials Europe. Returning to the U.S. in 1997, he was appointed group Vice President, Label and Packaging Materials North America and Labels and Packaging Materials Europe. Two years later, he was promoted to group Vice President, Label and Packaging Materials Worldwide. In 2000, he was elected President and Chief Operating Officer. From 2005 until his retirement in 2016, Mr. Scarborough served as President and Chief Executive Officer and as Chairman of the Board from 2010 to 2016. He retired as Chairman of the Board of Avery in 2019. Additionally, Mr. Scarborough was on the Board of Directors of Cardinal Health, Inc. until November 7, 2022, and currently serves as a director of Beontag, Inc.

Qualifications: The Board concluded that Mr. Scarborough is qualified to serve as a Director of the Company because of his service as the Chief Executive Officer of Avery Dennison Corporation, a publicly-traded packaging and labeling solutions company, and also formerly served as the Chairman of the Board of Directors of such Company. In addition, Mr. Scarborough served for over ten years on the Board of Directors of Mattel, Inc., the world’s largest toy brand. He brings extensive experience in building brand and stockholder value to the Company.

|

|

|

Larry M.

Former Executive

|

Biographical Information: Larry M. Venturelli, 64, joined the Company’s Board on May 25, 2016. Mr. Venturelli is the former Executive Vice President and Chief Financial Officer of Whirlpool Corporation, the world’s leading global manufacturer of home appliances, and he served in this capacity from January 2012 to August 2016, retiring from the company in February 2017. He joined Whirlpool as Assistant Corporate Controller in 2002. He held a number of positions of increasing leadership accountability in the Investor Relations and Global Finance organizations, serving as Senior Vice President, Corporate Controller, Chief Accounting Officer and Chief Financial Officer for Whirlpool International. Prior to joining Whirlpool, Mr. Venturelli held various financial positions at Royal Caribbean Cruises, Campbell Soup Company and Quaker Oats.

Qualifications: The Board concluded that Mr. Venturelli is qualified to serve as a Director of the Company because he has over 30 years of corporate finance experience, including approximately five years of experience as the Chief Financial Officer and 4 years as the Corporate Controller of Whirlpool Corporation, a U.S. manufacturing company with revenues exceeding $20 billion. In addition, Mr. Venturelli has 16 years of experience working for U.S. food products companies and has served as the head of Investor Relations.

|

|

| Page 14 |

2025 Proxy Statement |

|

Table of Contents

Proposal 1 — Election of Directors

Class II Directors — Terms to Expire in 2027

|

Aziz Aghili

Former Executive |

Biographical Information: Aziz Aghili, 66, joined the Company’s Board on March 1, 2022. Mr. Aghili previously served as Executive Vice President and President, Heavy Vehicle Group of Dana Incorporated, a global leader in drivetrain and e-propulsion systems for commercial and industrial vehicles. Mr. Aghili joined Dana Incorporated in 2009 as President of Dana Europe, before being named President of Dana Asia-Pacific in 2010, President of Off Highway Driveline Technologies in 2011, Executive Vice President and President of Highway Driveline Technologies in 2012, and to Executive Vice President and President, Heavy Vehicle Group in 2021. During his time with Dana, Mr. Aghili has also led the company’s Global Aftermarket group. Prior to joining Dana Incorporated, Mr. Aghili spent more than 20 years at Meritor, where he most recently served as Vice President and General Manager of Body Systems, a $1.4 billion division with 24 global manufacturing facilities based in Europe. Additionally, he held strategic leadership positions around the world, including Vice President and General Manager of Asia Pacific and Vice President of Global Procurement, Commercial Marketing, and Business Development – Asia Pacific. Mr. Aghili also spent several years in the U.S., Malaysia, and Australia. Before joining Meritor, he worked for Nissan Motor Company and General Electric Plastics. Mr. Aghili is a member of the Board of Directors of Columbus McKinnon Corporation and NFI Group Inc.

Qualifications: The Board concluded that Mr. Aghili is qualified to serve as a Director of the Company because he has over 30 years of experience managing manufacturing businesses and has extensive international business experience, particularly in Europe and Asia. In addition, Mr. Aghili has served on the Board of Directors of another public company, Columbus McKinnon Corporation since 2018 and joined the Board of Directors of NFI Group Inc. in January 2025.

|

|

|

Philip R. Martens

Former President Officer, Novelis Inc.

|

Biographical Information: Philip R. Martens, 64, was appointed Chairman of the Company’s Board of Directors on May 25, 2016. He joined the Company’s Board on November 21, 2013. Mr. Martens is the former President and Chief Executive Officer of Novelis Inc., a rolled aluminum manufacturing company, and he served in this capacity from 2009 to 2015. Prior to his employment with Novelis, Mr. Martens served as Senior Vice President of light vehicle systems for ArvinMeritor Inc., a distributor for engine and transmission parts, and President and Chief Executive Officer designate of Arvin Innovation, a leading global provider of dynamic motion and control automotive systems. Prior to that, Mr. Martens served as President and Chief Operations Officer of Plastech Engineered Products. From 1987 to 2005, he held various engineering and leadership positions at Ford Motor Company, most recently serving as group Vice President of product creation. Mr. Martens is also Chairman of the Board of International Automotive Components.

Qualifications: The Board concluded that Mr. Martens is qualified to serve as a Director of the Company because he has over 25 years of senior management experience, including serving as Chief Executive Officer of two public manufacturing companies, including a company which is significantly larger than Graphic Packaging Holding Company. Mr. Martens also has extensive experience in international operations and business in Europe, South America and Asia where the Company currently has operations.

|

|

|

|

2025 Proxy Statement | Page 15 |

Table of Contents

Proposal 1 — Election of Directors

|

Lynn A.

Former Senior Vice

|

Biographical Information: Lynn A. Wentworth, 66, joined Graphic Packaging Holding Company’s Board on November 18, 2009. Ms. Wentworth is the former Senior Vice President, Chief Financial Officer and Treasurer of BlueLinx Holdings Inc., a building products distributor, where she served from January 2007 until February 2008. Prior to joining BlueLinx, she was most recently, Vice President and Chief Financial Officer for BellSouth Corporation’s Communications Group and held various other positions there from 1985 until 2007. She is a certified public accountant. Ms. Wentworth was also appointed to the Board of Directors for CyrusOne, Inc. in May 2014, and was elected the Chairman of the Board on May 18, 2021. She also serves as chair of the Audit and Finance Committee and as a member of the Transaction Committee and Compensation Committee for CyrusOne. Ms. Wentworth was elected to the Board of Directors of Benchmark Electronics, Inc. on June 25, 2021, and also serves as the Chairman of the Audit Committee. She was also elected to the Board of Directors of Lineage, Inc., a privately held cold storage REIT on July 1, 2022, and serves as the Chairman of the Audit Committee. She is the former Chairman of the Board of CyrusOne, Inc. and Cincinnati Bell, Inc.

Qualifications: The Board concluded that Ms. Wentworth is qualified to serve as a Director of the Company because she has over 30 years of public accounting and corporate finance experience, including her service as the Chief Financial Officer of BlueLinx Holdings, Inc., a public company, and the Communications Group of BellSouth Corporation, as well as her extensive board and corporate governance experience.

|

|

| Page 16 |

2025 Proxy Statement |

|

Table of Contents

Proposal 1 — Election of Directors

CRITERIA FOR POTENTIAL DIRECTORS

The Company’s Board is responsible for selecting nominees for election as Directors by stockholders and for filling vacancies on the Board. The Nominating and Corporate Governance Committee is responsible for identifying and recommending to the Board individuals for nomination as members of the Board and its committees and, in this regard, reviewing with the Board on an annual basis the current skills, background and expertise of the members of the Board, as well as the Company’s future and ongoing needs. This assessment is used to establish criteria for identifying and evaluating potential candidates for the Board. However, as a general matter, the Nominating and Corporate Governance Committee seeks individuals with significant and relevant business experience who demonstrate:

| • | the highest personal and professional integrity; |

| • | commitment to driving the Company’s success; |

| • | an ability to provide informed and thoughtful counsel on a range of issues; and |

| • | exceptional ability and judgment. |

The Nominating and Corporate Governance Committee regularly assesses the skills, background and expertise of the members of the Board and identifies the Company’s needs. As part of this process, the Nominating and Corporate Governance Committee strives to select nominees with relevant business experience, the personal characteristics described above and a wide variety of skills and perspectives informed by different cultural and life experiences. The table below highlights certain experiences, skills and knowledge held by each of our continuing Directors and Nominees that are relevant to the Company’s business. The table reflects information provided by each of our Directors in their responses to our annual Director’s Questionnaire. The table is a summary and is not intended to be a complete list of each Director’s or Nominee’s skills or contributions to the Board. No one experience, skill or attribute is dispositive in the Board’s decision to nominate or re-nominate an individual to our Board of Directors.

|

|

2025 Proxy Statement | Page 17 |

Table of Contents

Proposal 1 — Election of Directors

DIRECTORS’ SKILLS MATRIX

| Skills* |

Aghili | Brlas | Callahan | Doss | Hagemann | Martens | Maselli |

Scarborough | Venturelli | Wentworth | ||||||||||

| Senior Executive Leadership Experience (experience as a CEO, CFO or other top executive leading a division or corporate function) |

X | X | X | X | X | X | X | X | X | X | ||||||||||

| Operations Experience (experience leading teams performing complex manufacturing, logistics and supply chain activities) |

X | X | X | X | X | X | X | X | ||||||||||||

| International Business Experience (experience managing operations and personnel and addressing customers and markets outside of the U.S.) |

X | X | X | X | X | X | X | X | X | |||||||||||

| Mergers and Acquisitions Experience (experience assessing potential acquisitions and structuring, negotiating and integrating significant acquisitions) |

X | X | X | X | X | X | X | X | X | X | ||||||||||

| Innovation Management Experience (experience in the areas of research and development and marketing and promotion of new products in varied markets) |

X | X | X | X | X | X | X | X | ||||||||||||

| Cybersecurity Risk Management and IT Expertise (experience providing meaningful understanding of information technology systems and the mitigation of cybersecurity risks) |

X | X | X | X | X | |||||||||||||||

| Human Capital Management Experience (experience with programs to identify, attract, compensate, retain and develop talent, to create a high- performing, engaged company culture and manage succession of key officers) |

X | X | X | X | X | X | X | X | X | X | ||||||||||

| Environmental, Social and Governance (experience with the development and oversight of an effective corporate responsibility strategy, including disclosures and mitigation of both legal and reputational risks) |

X | X | X | X | X | X | X | X | X | |||||||||||

| Sustainability and Climate Risk Management Experience (experience with the implementation and oversight of an effective sustainability program, including climate risk management, and related disclosures to regulators and the public) |

X | X | X | X | X | |||||||||||||||

| Years of Other Public Company Board Service (the aggregate number of years of public company board service, excluding service on Graphic Packaging Holding Company’s Board of Directors) |

6 | 33 | 5 | 4 | 26 | 25 | 3 | 31 | 0 | 28 |

| * | Generally, the skill or expertise is in addition to experience on the Company’s Board of Directors. |

| Page 18 |

2025 Proxy Statement |

|

Table of Contents

Proposal 1 — Election of Directors